Statoil Invests NOK 49 billion in the Johan Castberg Field

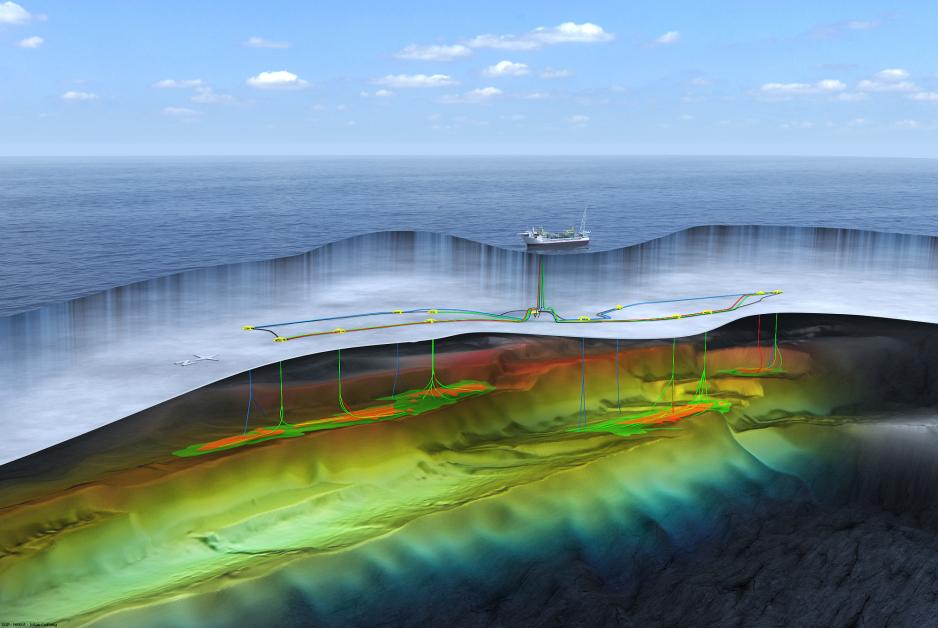

While the investment is smaller than former estimates of what the development of this Barents Sea field would cost, Statoil nevertheless promises to make the field profitable. Situated to the northwest of Hammerfest, Norway the development of Johan Castberg will provide new jobs in Northern Norway during both the development and the operations phase.

Today Statoil submits its plan for development of and operations on the Johan Castberg project on itself and its license partners Eni and Petoro.

Several main contracts are to be awarded to Norwegian industry.

- This is a big day. We have finally succeeded in realizing the Johan Castberg development. The project will be a key in the further developing of the High North, and it will create significant value and ripple effects for Norway, says Margareth Øvrum, Executive Vice President of Technology, Projects & Drilling at Statoil, in a press statement.

Significant ripple effects in the High North

The investment costs for Johan Castberg will be approximately NOK 49 billion and the work is scheduled to commence in 2022.

The exploitable resources are estimated at 450-650 billion barrels of oil equivalents, which makes Johan Castberg the largest offshore oil and gas development project in the world decided on in 2017.

Operations on Johan Castberg will be maintained with a supply and helicopter base located in Hammerfest and the operating organization located in Harstad.

Investments in operating the field are estimated at NOK 1.5 billion on an annual basis. That constitutes some 1,700 FTEs nationally, 500 of which will be located in Northern Norway. This includes both direct and indirect effects.

Press spokesperson Eskil Eriksen of Statoil says to Norwegian broadcaster NRK that the construction phase will include some 1,800 FTEs in northern Norway and that the major ripple effects will emerge in the operating phase.

- We are talking about a field that will operate for some 30 years and have an estimated 500 FTEs in northern Norway, he says in a comment.

Halved the investment costs

Vice President Øvrum admits that the Johan Castberg field has posed a challenge.

- This project was not viable due to high investment costs of more than NOK 100 billion and would only be profitable if the oil price was more than 80 dollars per barrel. We have worked hard together with our suppliers and partners, changed the concept and thought out new solutions in order to realise this development. Today we submit a rock-solid development plan for a field with only half the investment cost requirements and one that will be profitable with oil prices even below 35 dollars per barrel, she says.

Johan Castberg will be the sixth field in northern Norway to come into production.

- This field will be crucial in our further development of the oil and gas industry in the High North. We will also build infrastructure in a new area of the Norwegian shelf. We know from experience that this will lead to new development opportunities, says Arne Sigve Nylund, Statoil’s Executive Vice President of Development & Production Norway.

While submitting the development plan, Statoil also signs contracts for both underwater production systems for Johan Castberg and for EPma (projecting and purchase management), both with Aker Solutions. These contracts combined have an estimated value of NOK 4 billion per year.

The Johan Castberg partnership consists of Statoil (operator, 50 percent), Eni (30 percent) and Petoro (20 percent).

Les artikkelen på norsk