Frozen waters: Northern Sea Route traffic boosted by internal traffic, while transits fall sharply

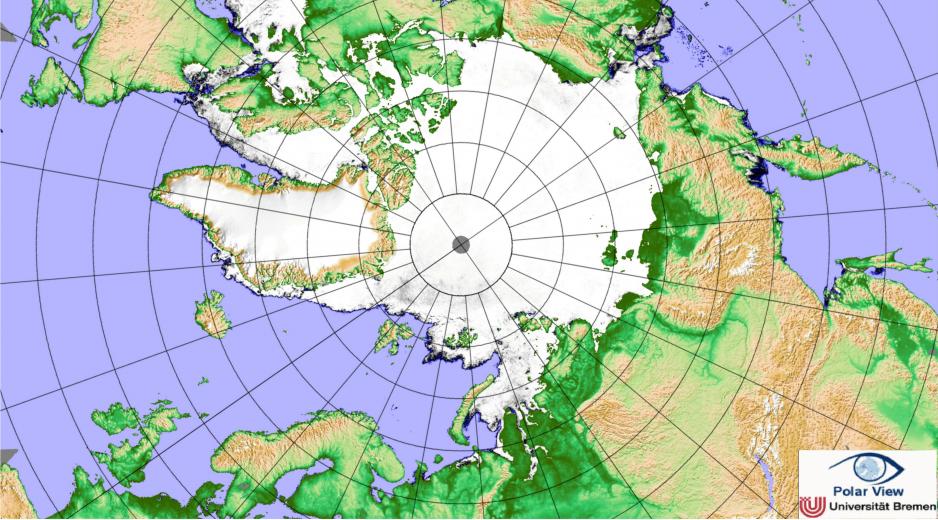

As ice reclaims the waters along the Northern Sea Route (NSR), the 2015 shipping season along the Russian coast line has come to a close. Officials have released preliminary transit and cargo figures for the NSR.

As ice reclaims the waters along the Northern Sea Route (NSR), the 2015 shipping season along the Russian coast line has come to a close. Officials have released preliminary transit and cargo figures for the NSR.

Total cargo volume, meaning the amount of cargo carried by all vessels navigating along the NSR, increased by 60 percent year-over-year to 5.15 million tons according to Yury Kostin, Deputy Head of Rosmorrechflot (Federal Marine and River Transport Agency).

In 2013 total cargo volume stood at 2.8 million tons and at 3.7 million tons in 2014. Activity by major energy projects in the region contributed to the increase in cargo volume, in particular oil production by Gazprom Neft’s Prirazlomnaya platform and the development of Yamal LNG.

Of this year’s permits, the majority went to Russian-registered vessels, with 63 granted to vessels flying foreign flags. Vessels from the Netherlands accounted for 13 permits, while vessels from Liberia and the Bahamas each had 7 permits. However, the number of permits granted does not directly correlate to the number of vessels that actually operated along the route in a given season.

While domestic internal traffic along the NSR increased, international transit traffic using the NSR for transport from Europe to Asia or vice versa has declined significantly from its peak in 2012. Transit shipping along the Northern Sea Route has decreased from an all-time high of 1.26 million tons in 2012 to 1.176 million tons in 2013, then declined sharply to 274,000 tons and 39,000 tons in 2014 and 2015 respectively.

Similarly, the number of transits, meaning ships traveling the full length of the route, has decreased by around 75 percent over the past two seasons. While officials recorded 71 transits in 2013, that number decreased to 22 last year and this year saw only 17 transits.

In light of these low figures questions about the profitability and competitiveness of the route continue to linger. “Low bunker oil prices have made the Northern Sea Route less attractive for ship-owners,” stated Russia’s Deputy Minister of Transport Viktor Olersky in Reykjavik in October 2015.

Nonetheless, the China Ocean Shipping Company (COSCO) reaffirmed this year its interest in shipping along the NSR and is currently assessing the possibilities for starting a regular shipping service between Europe and Asia along the route.

In 2013 COSCO’s “Yong Sheng” - a multipurpose cargo vessel - became the first Chinese merchant ship to transit the Arctic via the NSR. The ship completed its second journey along the route this August and exited the NSR at the Kara Strait on August 12th. The vessel departed from the Chinese port of Dalian on July 8th and arrived in Varberg, Sweden on August 17th. The vessel’s return voyage via the same route was concluded on October 4.

Russian officials believe that China’s “One Belt - One Road” economic development strategy which outlines a Maritime Silk Road for the 21st century will boost transit traffic along the NSR over the coming years. Furthermore, the introduction of a host of new icebreakers - currently under construction - will reduce wait times for icebreaker escorts and allow for an increase in transit cargo. In addition, once construction efforts at Yamal LNG wind down, additional icebreaker capacity, currently tied up for that project, will again become available.

However, even with the potential for increased shipments by China or COSCO, Russian officials admit that traffic on the route will not become an alternate to the Suez Canal. While a total cargo volume of 80 million tons is anticipated by 2030, the vast majority will be cargo to and from Russian ports in the form of oil, gas, and ore concentrate as well as supplies for new industrial projects; alone the combined annual capacity of the Prirazlomnaya platform and Yamal LNG is 23.1 million tons. It is projected that only 5 million tons of total cargo volume on the NSR, equal to around 6 percent, will be transit cargo. Hence, the development of the NSR as a shipping route will in large part be dependent on other economic activity in the Russian Arctic, which relies on maritime transport to develop infrastructure and to export products to markets outside the Arctic.