Russia’s Arctic ‘Yamal LNG’ Gas Plant Saw a Record 287 Cargo Loadings in 2024

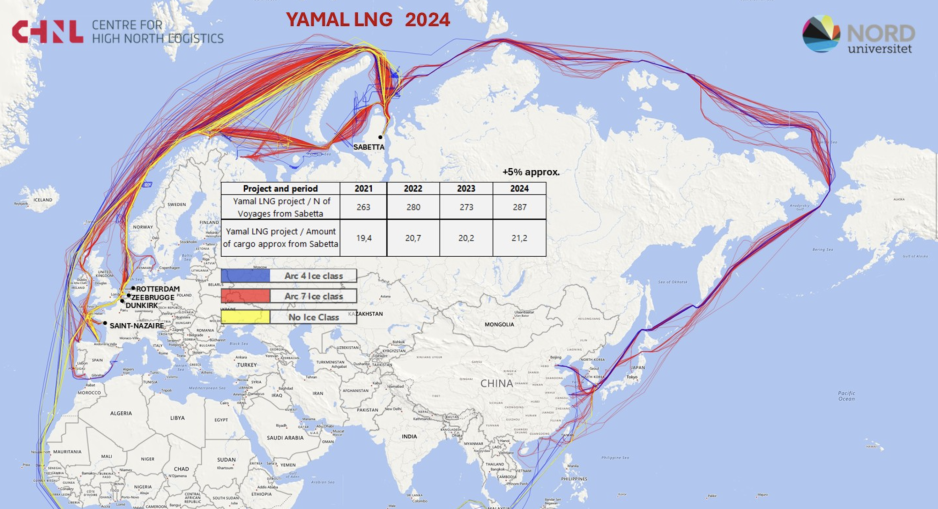

Map showing Yamal LNG exports in 2024. (Source: CHNL)

While Western sanctions have impeded or complicated much of Russia’s energy economy, the Yamal LNG plant continues to export liquefied gas like clockwork. Every month around 25 vessels load cargo at the Sabetta terminal, for a total of 287 deliveries in 2024, new data by Center for High North Logistics show.

The liquefied natural gas (LNG) business in Russia keeps on booming, especially in the Arctic. New data show that the country’s largest active liquefied natural gas plant, Yamal LNG, dispatched 287 vessels each loaded with 74,000 tonnes of the supercooled gas during 2024.

More than 200 voyages passed along Norway’s coastal waters in the Barents and Norwegian Seas.

In total exports from Novatek’s Yamal plant reached 21.2 million tonnes last year. This represents 2.5 percent more than during the previous record year of 2022 and 5 percent more than last year. The figures were compiled by the Center for High North Logistics.

For around half the year the facility can only be reached by highly specialized Arc7 ice-class LNG carriers. But CHNL figures show that increasingly during the summer and fall months vessels of lower ice classification or even conventional gas carriers can travel to the facility.

Out of the 287 voyages, 19 were conducted by medium Arc4 ice-class ships and 17 LNG vessels had no ice-strengthening at all.

Relying on a small fleet

Russia’s efforts to ship LNG through the Arctic continues to rely on a fairly small fleet of gas carriers. Just 26 vessels completed the 287 deliveries in 2024. And the composition of the fleet has remained highly consistent over the past several years.

The core fleet of 15 Arc7 vessels is supplemented by less than a dozen other gas carriers.

Europe has remained a key market for Russian LNG from Yamal, despite ongoing policy discussion to phase out the fuel. Close to 80 percent of deliveries, 227 out of 287, were bound for Europe.

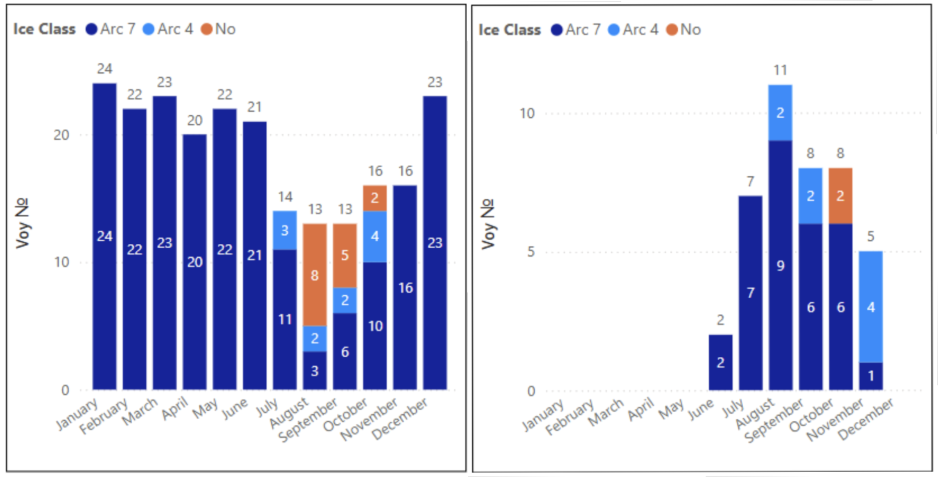

Yamal LNG deliveries to Europe (left) and Asia (right) during 2024 by month and ice class. (Source: CHNL)

A winter high

In Europe the countries of France (88 deliveries), Belgium (62), and Spain (54) were the largest buyers of Russian LNG, though some shipments only passed through terminals in the countries before being re-exported.

This practice has now been disallowed under the EU’s transshipment ban taking effect on March 27.

Shipments to Europe are highest during the winter months when the direct route to Asia via the Northern Sea Route is blocked by thick sea ice. During the summer months transport to EU ports is reduced in favor of dispatching cargoes directly to Asia.

Limited

Russian officials have long spoken of the possibility of year-round shipments to Asia via the Northern Sea Route, but this option has not materialized beyond a handful of trial voyages. For now trans-Arctic shipments remain limited to the months from June to December, data show.

During those six months the Yamal project dispatched 41 voyages to Asia, with China as the primary buyer receiving 35 shipments. The relatively quick delivery time from Yamal to China via the Arctic is key to the facility's economics.

Voyages from the Yamal peninsula to ports in China took just 19 days on average, around 50 percent faster than deliveries via the traditional route through the Suez Canal.