From Ukraine to the Arctic: The War's Impact on Russia's Northern Energy Ambitions

Two years into the full-scale invasion of Ukraine, Western sanctions call into question the future of Russia's Arctic energy ambitions. Russia aims to boost annual production of liquefied natural gas to 100 million tonnes, thus capturing 20 percent of the global market, by 2030. However, U.S. measures strike at the heart of Russia's Arctic plans. Sanctions now target project construction, ship-building, and marketability of liquefied gas.

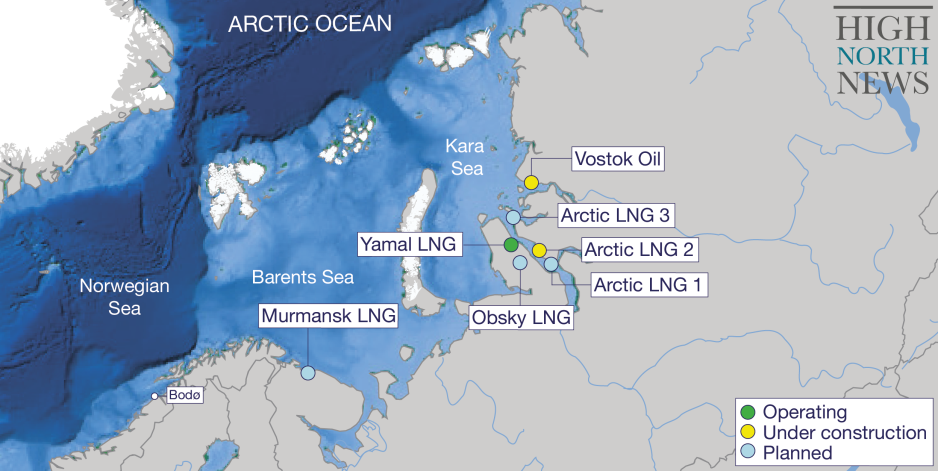

Through interviews with more than a dozen experts this article explores how sanctions will affect Russia’s ability to operate existing facilities, like Yamal LNG, and complete projects currently under construction, including Arctic LNG 2. It also takes a look at its capacity to finance and construct future ventures, such as Murmansk LNG, and how the reach of sanctions extends to non-LNG projects, like Vostok Oil.

Success story with an expiration date?

Russia’s first Arctic mega-project, Yamal LNG, began commercial operation in December 2017. Since then the facility, majority-owned by gas company Novatek, has produced more than 100 million tonnes of LNG. The project relies on a fleet of 15 ice-capable Arc7 LNG carriers. Since 2017 these vessels have completed around 1250 voyages shuttling product to Europe and Asia; each delivery valued in excess of USD 30 million.

“Right now Yamal LNG is the cash cow, and all efforts are spent by Novatek to keep it that way,” confirms Mehdy Touil, a liquefied natural gas (LNG) Operations Specialist, who in the past worked as a senior operator for the company’s Yamal project.

Location of current and future Russian LNG projects and Vostok Oil. (Source: HNN)

The European Commission and EU member states have thus far resisted calls for a ban on Russian LNG, but critical voices are mounting. In April the EU Parliament will vote on a measure that would, for the first time, give member states the means to restrict the flow of Russian LNG into European terminals.

A full phase-out may not be far behind as European officials, including Ministers in Spain and Belgium, are calling for more comprehensive measures.

With ample global LNG production and European efforts to diversify gas supply largely successful, the continent could begin transitioning away from Russia without noticeable impact on prices, recent studies indicate.

Some sub-regions, e.g. the Iberian Peninsula, may need longer transition periods, says Angelos Koutsis energy policy officer at Bond Beter Leefmilieu, a Belgian environmental association. Russian LNG accounts for 20 percent of Spain’s gas supply. But by and large the continent is no longer reliant on Russian deliveries.

And rapid expansion from the U.S. and Qatar will further ease supply concerns. In 2025 projects in the U.S. – Corpus Christi phase 3, Golden Pass train 1, Plaquemines phase 1 – and in Canada will add around 45 million tonnes of annual production. Additional capacity from the U.S. and Qatar will come online in 2026.

“The significant uptick in supply availability is expected to ease fundamentals and prices, so there may then be less appetite for Russian LNG,” explains Ana Subasic, natural gas and LNG analyst at Kpler, a data and analytics firm for commodity markets.

“When European supply-demand balances become more comfortable there is the potential to sanction Yamal as well, although the primary focus at the moment is future Russian LNG projects,” she continues.

In fact, EU Energy Commissioner Kadri Simson confirmed that ample supply from the U.S. will be crucial to phasing out Russian LNG. "In the EU, we are progressively building up pressure on European players to reduce Russian LNG purchases, and here again confidence in U.S. supplies is important," she stated to Bloomberg over the weekend.

Access to markets and transport

Yamal LNG achilles heel is two fold: Its reliance on European terminals and dependence on ice-cable LNG carriers.

An EU ban on Russian LNG would be detrimental to the Yamal LNG project. A shortage of ice-capable Arc7 LNG carriers further enhances Novatek’s logistical challenges.

“It seems that by targeting [with sanctions] the Arc7s, Russian Arctic LNG projects, notably those along the Northern Sea Route east of the Kara gates, are in peril,” says Ben Seligman, a project specialist for Arctic oil and gas development.

In fact, Novatek’s and by extension Russia’s dependence on the European market is now an order of magnitude greater than the EU’s reliance on Russian LNG.

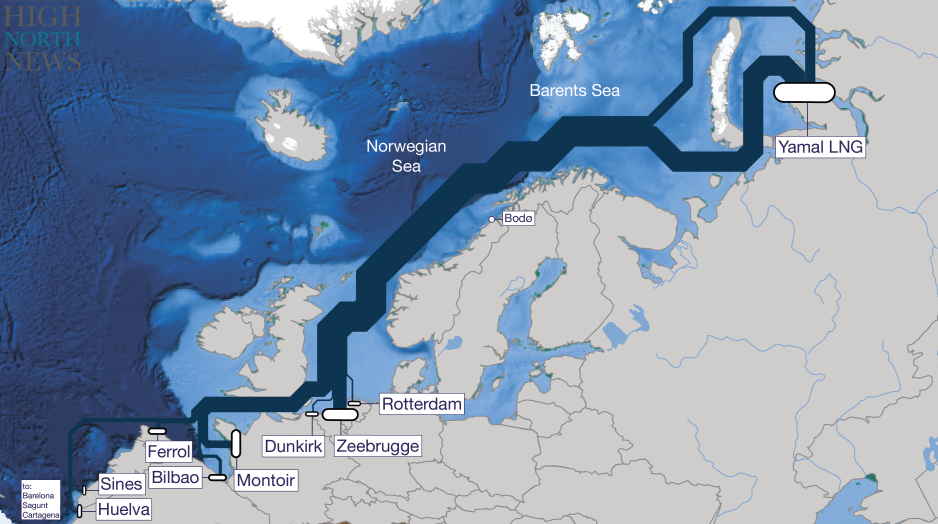

Yamal LNG deliveries to the EU between February 2022 and June 2023. (Source: HNN)

In 2023 Russia sent LNG valued at 8.1 billion Euro to European countries via its primary LNG export port, Sabetta, says a new report by Urgewald, a German non-profit environmental organization.

Will the door close for Yamal LNG?

Novatek’s Yamal LNG project produces around 20-21 million tonnes of LNG annually. Located on the Yamal peninsula along the shores of the seasonally ice-covered Ob Bay it relies on a fleet of 15 ice-capable vessels.

Around 85 percent of the plant’s production is destined for the European market. Here some cargo is transshipped to third countries. The remaining share is sent directly to Asia via the Northern Sea Route – primarily to China and Japan – during the summer and fall months, when ice conditions allow for direct deliveries to the Far East.

Russia’s plans for regular, year-round shipments to Asia have thus far not materialized, contrary to repeated official announcements. Experimental winter voyages routinely take a month or longer even with nuclear icebreaker escorts. Navigating the Arctic Ocean remains a formidable challenge, even in the face of accelerating climate change.

Yamal LNG relies on long-term offtake agreements to distribute its product in Europe.

"Novatek’s portfolio includes contracts for transshipment in France while Yamal LNG has transshipment contracts in Belgium,” explains Ana Maria Jaller-Makarewicz, Lead Energy Analyst for Europe at IEEFA, a global think tank examining issues related to energy markets, trends, and policies.

At Montoir-de-Bretagne in France Novatek has offtake agreements with Shell for 0.9 million tonnes per year and 1.0 million tonnes with TotalEnergies. Both deals run through 2041. In neighboring Belgium, it relies on a 20-year contract through 2038 with natural gas transmission system operator Fluxys. The company transships up to 8 million tonnes of Yamal LNG annually via the Zeebrugge terminal.

These long-term agreements have thus far provided certain protections for Novatek against the phasing-out of LNG from Yamal.

“In the short term, Yamal LNG shipment will still benefit from long-term 20-years contracts,” confirms Hervé Baudu, Arctic shipping expert and Chief Professor of Maritime Education at the French Maritime Academy (ENSM).

Thus far it remains unclear if or how EU member states could terminate existing contracts. But the currently proposed measures – up for a vote in the EU parliament in April – appear insufficient to tackle the legal barriers to ending transshipment of Russian LNG in the EU.

“It is not entirely clear if we can work with [what’s proposed by the EU],” explained Belgium’s energy minister Tinne Van der Straeten last month.

“Public pressure to restrict access to the European market is rising,” confirms Koutsis, at Bond Beter Leefmilieu.

The EU’s latest discussions suggest that an eventual phase-out of Russian gas, including LNG, is not too far off.

“This year we do not expect to see a ban on Russian LNG – it is very hard to pass unanimously – but the EU said they would stop importing Russian gas by 2027,” confirms Subasic at Kpler.

Rise and fall

Without access to the European market, Novatek could attempt deliveries via Turkey or Egypt, at the penalty of doubling the sailing distance.

“The delivery and transfer of LNG in EU ports is of vital importance for Russia. While a trip from Yamal to Zeebrugge takes about six to seven days, the journey to the next closest ports in Turkey would require at least 14 days,” explains Sebastian Rötters, energy analyst at Urgewald, the German non-profit.

Ice-capable Arc7 carriers already operate at cost penalty as their hull shape and thickness is optimized for ice-covered waters.

“The cost of shipping LNG using ice-class carriers is much more than using standard LNG tankers. Operating costs for standard LNG tankers are usually assumed to be 75 percent of those for Arc7 tankers, highlights Jaller-Makarewicz, the analyst at IEEFA.

The existing fleet of Arc7 vessels carries around 90 percent of Yamal LNG’s production. During the ice-free months gas tankers with lower or no ice-class supplement the Arc7s.

Each year the 15 Arc7 vessels transport around 15 million tonnes of LNG from the Western Arctic to central Europe – a roundtrip voyage of 14 days. The remaining volume makes the six week-long return journey to Asia during the summer and fall.

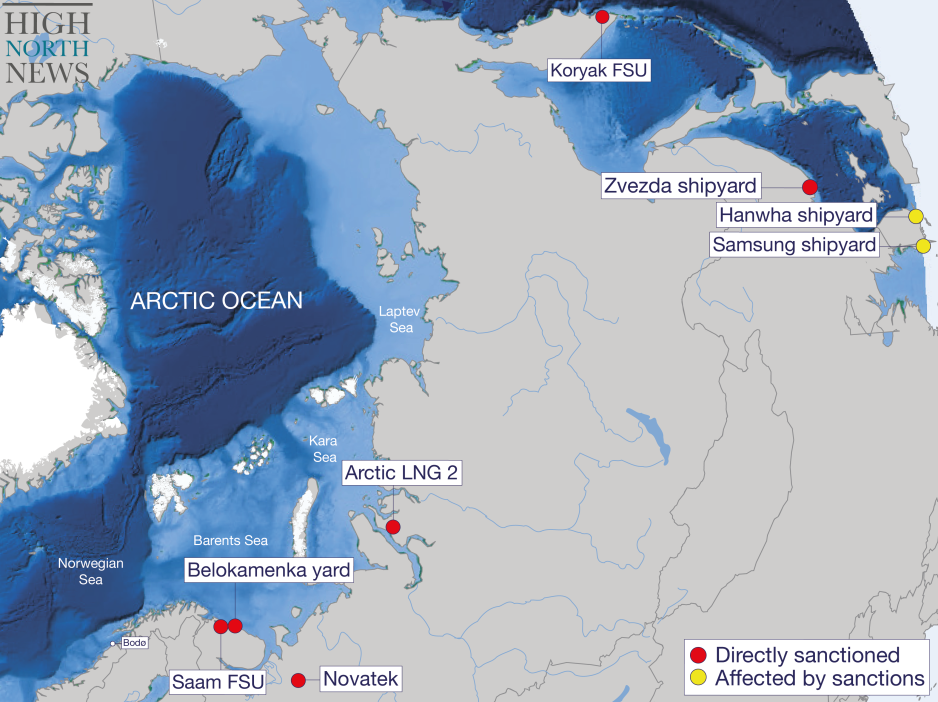

Novatek had plans to use two massive, custom-built, transshipment barges to optimize logistics – one on each terminus of the Northern Sea Route. Both barges – Saam FSU and Koryak FSU – have been in place since mid-2023. U.S. sanctions have rendered both vessels unusable, for now.

To overcome future logistical challenges Novatek will need to acquire additional Arc7 vessels; a near impossibility following US sanctions.

South Korean shipyard Samsung terminated construction contracts. Fellow shipbuilder Hanwha expressed uncertainty how to sell or place into service the six vessels it has under construction.

Efforts for domestic construction at Russia’s Zvezda shipyard have shown little progress. Only one or two vessels will likely enter into service in 2024 or 2025.

Recent U.S. sanctions targeting the yard may further slow down construction efforts. And experts suggest that Russia’s ability to independently construct LNG carriers – without help by South Korean or Japanese shipyards – sits at least another 5-7 years into the future.

Chinese providers may be eager to provide their services, but with full order books and lengthy waiting lists Novatek would likely look at 2028 or 2029 at the earliest.

Challenges are mounting

Yamal LNG’s potential challenges pale in comparison to the hurdles Arctic LNG 2, Novatek’s next project, faces.

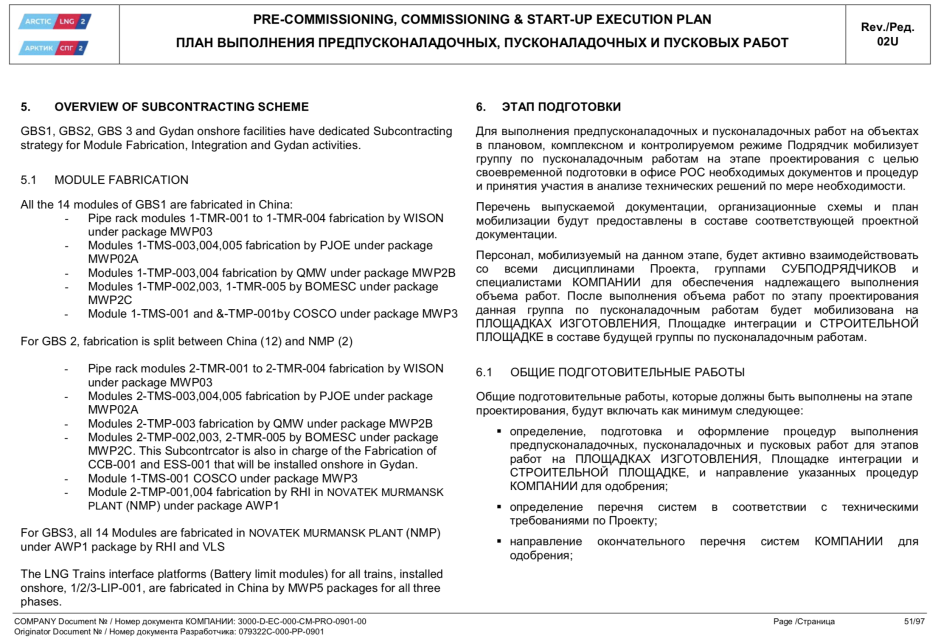

Construction on the project with a nameplate capacity of 19.8 million tonnes began in 2018. Rather than assembling the plant on site, Novatek relies on a large-scale construction yard, Belokamenka, near Murmansk. Prefabricated modules arrive from builders across China on board heavy load vessels for integration onto massive floating platforms called gravity based structures, or GBS. The finished production line is then towed 1,200 nautical miles to the Gydan peninsula.

When Western sanctions took effect in spring 2022 the first platform was nearing completion. But crucially American company Baker Hughes, supplier of gas turbines for the liquefaction process, had only delivered four out of seven LM9000 turbines for train 1.

The lack of turbines required an extensive redesign to integrate older Chinese turbines rather than modern gas Western turbines, similar to those used on Boeing’s 777 jet.

While the fix seemingly allows Novatek to overcome the lack of key technology, it is fraught with uncertainty in terms of reliability, experts say.

“Novatek is in a precarious position with the Arctic LNG 2 project,” says Amit Kshatriya, an LNG project engineering consultant, who now runs AllThingsLNG, an online platform offering insights and educational content on the LNG industry.

“It is up to them to make it work without the support from turbine manufacturers Baker Hughes while introducing a new manufacturer for the remaining turbines. They may be able to produce LNG from train 1, but it is hard to make it work to its full capacity on an untested technology,” he continues.

A modified design

Novatek’s decision to switch to an all-electric design for train 2, thus eliminating the need for Baker Hughes’ turbines, will likely hold additional complications. Generally large-scale LNG projects use gas turbines for the liquefaction compression units.

Experts question how Novatek is going to solve electric drive design challenges. They point to the fact that only two large-scale electric-drive LNG plants exist in the world. Freeport LNG in the U.S. and Hammerfest in Norway. And both rely on Western suppliers for motors.

And the challenges don’t end there. Novatek is now looking to assemble the next production line, train 2, at Belokamenka after the final module arrives from China this month.

Previously Novatek relied on an international consortium of EPC (engineering, procurement, and construction) contractors. France’s Technip and Italy’s Saipem exited the project in 2023 leaving only Russian provider Nipigas.

“Novatek has to establish new interfaces with domestic and Chinese suppliers to work seamlessly for finishing train 1 and building train 2,” says Kshatriya. Novatek will have to solely rely on Nipigas for this process as the only remaining EPC contractor.

“Nipigas is no match for Technip when it comes to the coordination of liquefaction ISBL plant construction and no match for Saipem for OSBL plant construction including the work on GBS design,” Kshatriya continues. His comments refer to specific work inside and outside the plant.

Several experts point out that Nipigas has never coordinated project management for this type of design, especially on such a massive scale. There simply isn't a precedent for the company having been involved in such designs, an industry insider explained.

“Arctic LNG 2 is in much bigger trouble than it wants to show the world, but until the actual production quantities are seen, it is hard to gauge the extent of the problem with the Western sanctions affecting the plant. The project might produce LNG but will not produce it to its full capacity,” concludes Kshatriya.

Off the record, some LNG industry analysts went even further, suggesting that Western sanctions would “cripple the ambitions of Russian LNG projects in more ways than imaginable.”

U.S. sanctions targeting Arctic LNG 2 and related infrastructure. (Source: HNN)

But not all experts interviewed for this article were as categorical about the lack of Western technology.

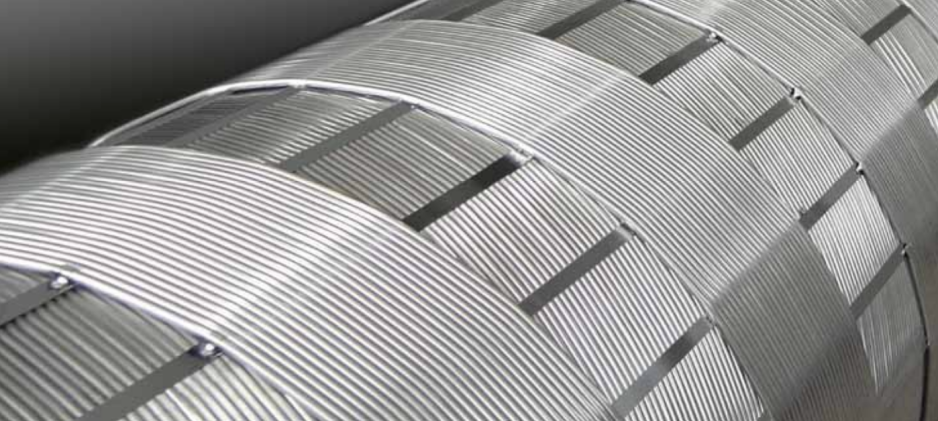

“Russia - thanks to Novatek in particular - has acquired and developed the know-how to manufacture cryogenic equipment, including Coil Wound Heat Exchangers (CWHEs) [used in LNG plants] from the defunct Linde joint venture, and can leverage its domestic capabilities to support its LNG plans,” explains Touil, the LNG Operations Specialist, who previously worked on Yamal LNG.

“While gas turbines and electric motors for train 2 of Arctic LNG 2 are procured from China, Russian alternatives for LNG applications are not that distant. Do not forget that Russia is still a space power,” he elaborates.

While analyst opinions diverged as to the scale of the impact, they agreed that the true scale will only become apparent once production and deliveries from Arctic LNG 2 begin.

The first delivery of LNG has been pushed back repeatedly from January to February and then March. Now analysts don’t expect shipments until May at the earliest.

“I believe it is still really important for Russia to secure a symbolic victory by exporting its first LNG cargo in the first half of 2024,” surmises Subasic at Kpler.

A kingdom for an ice-capable ship

An even greater sticking point for Arctic LNG 2 will likely be the availability of Arc7 carriers and marketability of LNG.

While Yamal LNG can rely on a full complement of 15 Arc7 vessels, the situation for Arctic LNG 2 is much more dire. The project has yet to receive a single carrier; out of a required fleet of 21 ships for all three trains.

Thus far, four vessels are nearing completion at Hanwha, with an additional two under construction until 2025 and 2026. The orders are caught in an expanding web of U.S. sanctions leading to growing uncertainty if or how they can ever be placed into service for Arctic LNG 2. South Korean shipyards are unlikely to construct any more Arc7 going forward.

“For now, we have pushed our expectations for a first cargo back to May, assuming another suitable foreign entity is set up to take over vessel ownership. This remains a major unknown, so these next several weeks are critical for Novatek,” confirms Subasic, the analyst at Kpler.

A complement of five vessels at Russia’s Zvezda shipyard, partially constructed by Samsung Heavy Industries, remains in limbo as well.

And Russia is cut off from key western technology to build the membrane containing the liquefied gas. French provider GTT left the country after completing work on only the first two vessels at Zvezda. Experts agree that the yard may be able to launch one or two vessels in 2024 but call into question the yard’s ability to complete any more in the coming years.

Originally Novatek had planned to export the majority of LNG produced at the facility to Asia, including during winter. Second-generation Arc7 carriers, even more powerful and capable than those in service of Yamal LNG, were to enable this ambitious goal.

Without Arc7 vessels the company will be forced to ship its LNG during a short ice-free period between August and November using conventional LNG carriers. And even then, shipping experts caution that Novatek may not be able to find vessel operators willing to carry sanctioned LNG.

“If it does start up, it’s safe to say it will be massively underutilized due to limited Arc7 availability,” concludes Subasic.

Who will buy sanctioned LNG?

The latest round of U.S. sanctions directly targets the Arctic LNG 2 project. This raises questions about the marketability of its LNG.

“Our objective is to kill that project,” said U.S. Assistant Secretary for Energy Resources Geoffrey Pyatt in November 2023.

Novatek’s international partners, who hold 40 percent ownership of the project and corresponding off-take rights, declared force majeure at the end of 2023. France’s Total said it would not receive any gas from the project and other European buyers will likely also steer clear of any imports.

Chinese and Japanese partners are currently looking to secure sanction waivers from the U.S.

“It does seem clear that Chinese companies that do business with a large number of Western companies have tended to be more compliant with sanctions as they do not want to be excluded from the Western markets,” explains Jason Feer, global head of business intelligence at Poten & Partners, a global ship brokerage advisor.

“As sanctions tighten, Chinese companies will have to decide which markets are more important and how much risk they are willing to take,” concludes Feer.

He also points to the global LNG supply situation – including recent plans by Qatar for massive expansion by 2030 – which may reduce the need for Chinese imports from Russia.

“With all the gas liquefaction plants being built, there will be competition [for Russia],” concurs Baudu.

As a result of sanctions Arctic LNG 2 may never reach its final buildout stage. France’s TotalEnergies, a minority partner in the project, announced that the third production line is on hold; a sign of the difficulties ahead for train 1 and 2.

Is there room for Murmansk LNG?

Novatek’s next project, Murmansk LNG, will face similar challenges related to engineering, logistics, and marketability. The company plans to employ the same GBS construction technique developed for Arctic LNG 2.

Murmansk LNG received priority approval from the Kremlin in October 2023. President Putin instructed lawmakers to include the project in the planned liberalization of LNG exports.

The project benefits from electricity surplus from the nearby Kola nuclear power plant. While Novatek has not revealed specifics, experts speculate that Murmanks LNG would also employ an electrical-drive liquefaction process applying learnings from Arctic LNG 2.

However, Novatek will have to rely on its proprietary, but hitherto untested, “Arctic Mix” liquefaction technology.

“It's one thing to get a patent but another entirely to function stably on large-tonnage trains of ~6.8 million tonnes per year,” cautions Seligman.

“They have hurriedly run a process simulation to certify the “Arctic Mix” liquefaction technology to be used for large-scale designs,” Kshatriya, the LNG consultant concurs.

Additional challenges relate to the GBS process at Belokamenka. With the facility now under U.S. sanctions Novatek will have to rely on domestic or possibly new Chinese suppliers.

“How will Novatek cope on its own with GBS construction, particularly as it relates to the LNG containment system and tanks inside the GBS? And what about the topside process modules,” elaborates Seligman.

For train 1 and train 2 of Arctic LNG 2 all but two modules, out of a total of 28, were constructed in China.

“For Murmansk LNG Novatek would hope to build most, if not all of them on their own at the Belokamenka yard. Novatek still lacks experience in this area. Can the many Russian suppliers be relied upon,” asks Seligman.

And then there is the question of LNG carriers. The waters around Murmansk remain ice-free year round. The project will thus not require specialized Arc7 vessels. But acquiring conventional LNG vessels may still prove very difficult for Russia. U.S. sanctions could effectively block their construction abroad or sale to Russian entities.

“Procuring LNG carriers will also be difficult, even though ice-class ones aren't needed. Sanctions will target them,” confirms Seligman.

With the European market likely off limits, the shipping economics do not look favorable. Traveling from the Barents Sea to possible buyers in Asia via the Suez Canal is a long way for LNG to travel, several experts pointed out.

Internal Russian logistics

The feed gas for Murmansk LNG will arrive from the Volkhovsky District in western Russia. This requires the construction of a 1,300 km pipeline; something the company has never done before. The project will also require ongoing cooperation between Gazprom and Novatek.

Securing the financing necessary for additional projects the size of Yamal LNG and Arctic LNG 2 may also prove a formidable hurdle for Novatek. Each project cost in the range of USD 20-30 billion.

Western financial institutions have now fully backed away from Novatek’s Arctic LNG 2 project, ahead of U.S. sanctions taking effect earlier this year on January 31, 2024.

Intesa Sanpaolo and Cassa Depositi e Prestiti (CDP), two Italian financial institutions that previously provided loan guarantees, terminated their involvement in early 2024. Likewise Italy’s Export Credit Agency SACE abandoned Arctic LNG 2 due to “the potential risk of secondary US sanctions.”

Only distant possibilities

In order to reach a projected capacity of 100 million tonnes of LNG production per year, Russia will have to complete additional facilities on the Gydan Peninsula.

Novatek’s Arctic LNG 1 and 3 project face obstacles of their own, including the need to confirm a sufficient resource base and recoverable reserves to underpin each project, experts say.

“Arctic LNG 1 has many license blocks on the Gydan Peninsula, both south and east of Arctic LNG 2, and only a few of these have been explored. Even if Novatek is able to drill enough exploration wells to complement their seismic, they may simply not find enough gas to produce 20 million tonnes per year of LNG,” speculates Seligman.

The same holds true for neighboring Arctic LNG 3, which is even further behind, with very little exploration drilling completed to date.

And of course located in ice-covered waters both projects will need to procure a fleet of Arc7 LNG carriers.

Without ice-capable tankers

The lack of ice-capable vessels also impacts plans for Rosneft’s mega project, Vostok Oil.

Rosneft has been engaged in year-round construction efforts for several years delivering enormous quantities of equipment and material to the mouth of the Yenisei River.

The project involves 700+ km of pipelines, a multitude of pump stations, power generation infrastructure and more. According to some reports Vostok Oil is the largest oil development project anywhere in the world in a decade and the biggest in Russia since the 1970s.

Russia’s lofty forecasts suggest production will grow to reach an annual production of 115 million tonnes of crude oil by 2030.

How this amount of oil will reach global markets via the ice-covered waters of the NSR, however, remains an unanswered challenge. And the question marks have grown larger as a result of Western sanctions.

Russia’s Zvezda yard has only built a single Arc6 crude oil carrier, Valentin Pikul, with at least 29 more needed for the project.

“We're only aware of a single vessel having been built so far. So, what does Rosneft have in mind to fill the shipping gap, particularly on the winter shipping and ice-class side of things,” asks Seligman.

During the brief summer season the company may rely on conventional crude oil carriers. Russia tested the use of Suezmax carriers on the route last summer, much to the dismay of environmentalists.

Russia may be looking abroad to procure additional ice-class shipping capacity, but like in the case of Arc7 LNG carriers, South Korean yards will presumably be of little help.

Will time be Russia’s friend?

While the current technological, logistical and marketability challenges look insurmountable, Russia holds incredible motivation to push forward with its Arctic projects. It has decades of experience operating and executing large-scale industrial projects in the Arctic.

Russian officials remain adamant that Arctic LNG 2 and future projects will be built, but concede that there will be some delays. Chinese technology will likely play a crucial role in replacing Western technology on future LNG projects.

“There will be delays, but when the situation with Ukraine improves, these capacities will already be built and they will be in demand on the market,” said a representative of the Russian government.

Time will likely be Russia’s greatest ally in pushing forward with its Arctic energy projects. Global LNG demand is forecasted to grow 40 percent by 2040. Its role as a transition fuel will keep it in high demand.

“The energy transition won't happen without LNG, which will be needed for another 40 years,” concludes Baudu.

And over that time Arctic sea ice will continue to melt providing even greater access to the region and easing the technological and logistical challenges Russia faces.