Spain and Belgium Buy Russian Arctic Gas at Record Rate, Officials Unsure How to Stop Imports

EU institutions have thus far been able to design policies to reduce the import of Russian LNG. (Photo: European Parliament)

European countries continue to buy more than half of Russia’s gas production. Throughout 2023 Spain emerged as a major importer surpassing previous record buyers France and Belgium, without concerted European effort to reduce import volumes. Norway also continues to expand its LNG portfolio, including to destinations outside the EU.

Despite European officials expressing support for measures to restrict the flow of Russian liquefied natural gas (LNG) into the EU, realities on the ground are trending in the opposite direction.

A new report by the Institute for Energy Economics and Financial Analysis using Eurostat data reveals how LNG imports from Russia continue to rise.

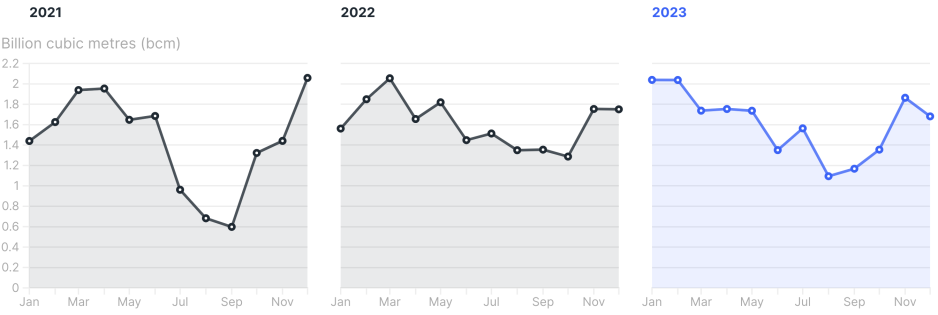

Between 2021 and 2023 deliveries of Russian LNG to Europe increased by 11 percent. Last year European countries imported 19.5 billion cubic meters (bcm) of LNG from the country; an additional 5.2 bcm were transshipped through Europe’s terminals and exported to non-European states.

In total EU countries purchased Russian LNG valued in excess of $30bn since the beginning of the full-scale war in February 2022. Over that time frame Russia represented the second-largest supplier of LNG to the EU, behind only the United States and ahead of Qatar and Algeria.

The vast majority of Russian LNG, 22.17 bcm in 2023, originates from Novatek’s Yamal LNG project in the Arctic.

EU LNG Imports from Russia, 2021, 2022, and 2023. (Source: Kpler, IEEFA)

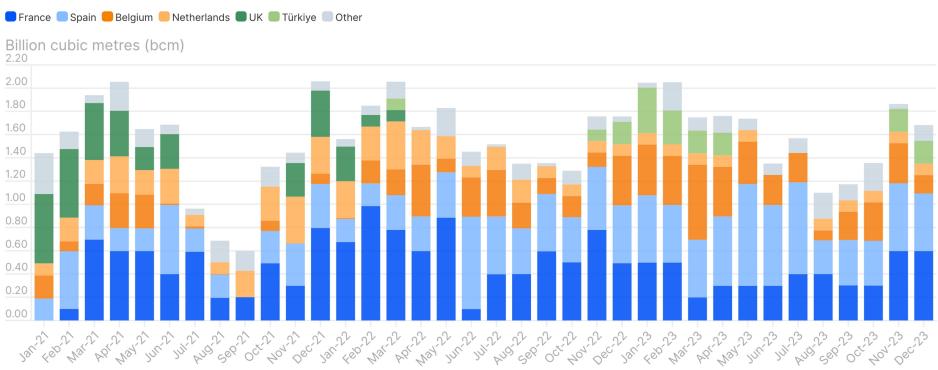

Since the beginning of the full-scale war in February 2022 Russian supplies to Belgium tripled and deliveries to Spain doubled. Imports continue also to France and the Netherlands, although at a somewhat reduced pace.

The United Kingdom represents a notable exception among the major importers having banned the import of Russian LNG since January 2023.

EU LNG Imports from Russia in 2021 - 2023 by month. (Source: Kpler, IEEFA)

Belgium’s Zeebrugge terminal represents a major hub for imports with around a third of all Russian supplies passing through that hub. Together Belgium, Spain and France account for 80 percent of imports.

European officials have struggled to find a definitive policy answer to limiting the flow of Russian, which at least indirectly supports Russia’s war effort sending several dozen billion of USD to the country.

Obstacles

Part of the challenge are existing import-export contracts as some LNG just passes through some EU countries before it is sent onwards.

Belgium's energy minister Tinne Van der Straeten stated last month that long-term transshipment contracts make it difficult to phase out Russian LNG.

"We are indeed also in Belgium confronted with specific contracts that were signed well before the war and it is now still an open point how to address this," she told a meeting of the EU Parliament's energy committee in January 2024, Reuters reported.

Confronted with specific contracts that were signed well before the war

"This is something that we cannot take on unilaterally," she cautioned.

However, the data show that this particular challenge is limited to Belgium, which transships around 50 percent of the Russian LNG it receives. France is the only other country that sends some of the LNG onward to third countries.

Norway expands position

Meanwhile Norway also continues to expand its role as a global LNG supplier, both from its own production at Hammerfest LNG and as a reseller of US supplies.

In 2023 Norway supplied around 5 percent of Europe’s LNG, up from 3.8 percent the year prior. Sales totaled 6.5bn Euro over that period. It also supplied around half of Germany’s natural gas needs via pipeline gas in 2023.

Earlier this week Equinor announced a 15-year deal to deliver 1.4 bcm of LNG per year, equivalent of around 15 percent of Hammerfest’s annual production, to Indian fertilizer and petrochemical company Deepak. The deliveries are set to start in 2026.