Russia Still Second Largest Gas Provider to EU, After Norway, with LNG Imports Increasing

EU energy commissioner Kadri Simson in Brussels during the presentation of the new State of the EU Energy Union report. (Source: European Union, 2024 / Aurore Martignoni/CCE)

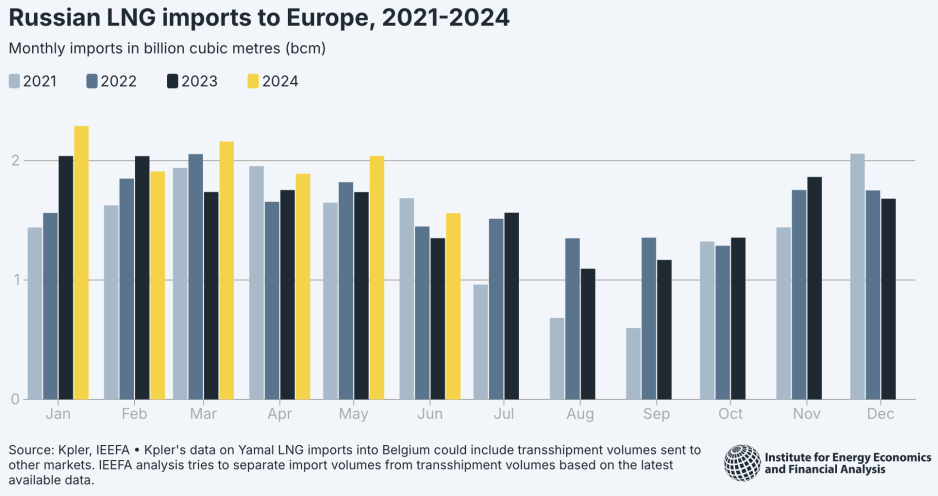

Despite the EU’s efforts to phase out imports of Russian LNG, the super-chilled gas from the Arctic continues to flow unabated into the continent. Imports have increased by 11 percent during the first half of 2024 new data show, with Russia now the second-largest supplier.

Two new reports on the EU’s energy landscape paint a mixed picture about the Union’s efforts to further reduce its imports of Russian natural gas, either via pipeline or in the form of super-chilled liquefied gas by tankers.

The 2024 State of the EU Energy Union report released this week highlights that the bloc still relies on Russia for close to 20 percent of its gas supplies. Russia remains the second-largest provider after Norway and ahead of the U.S.

An especially concerning trend is the continued increase in imports of liquefied natural gas or LNG, a new study by the Institute for Energy Economics and Financial Analysis (IEEFA), an independent global think tank, published Thursday confirms.

“Despite the EU agreeing to ban transshipments of Russian LNG by March 2025, EU ports’ transshipments of the fuel from Russia’s Yamal terminal increased 15% year on year in H1 2024,” says Ana Maria Jaller-Makarewicz, lead energy analyst, Europe, at IEEFA.

Russian LNG imports to Europe between 2021-2024, with the first half of 2024 setting new highs. (Source: Courtesy of IEEFA)

This news comes despite repeated efforts by the European Commission to curtail the flow of Russian LNG from the Arctic Yamal LNG project.

“We remain fully committed to completing the phase out of Russian gas, which can be done without challenging Europe's energy security of supply,” EU energy commissioner Kadri Simson told reporters in Brussels at the presentation of the EU Energy Union report.

EU continue to buy Russian LNG

However, trends have been moving in the opposite direction. Not a single EU member has applied the tools agreed upon earlier this year allowing states to unilaterally ban the import of Russian LNG by restricting terminal slots at import facilities.

Several EU states, especially France, have been moving in the opposite direction. France more than doubled its imports of Russian LNG during the first six months of 2024 compared to the same period in 2023, the new data conclude.

“While the European Union aims to curb its dependence on Russian fossil fuels, French imports of LNG from the country have soared this year. This is despite France’s natural gas demand continuing to decline,” explains Jaller-Makarewicz at IEEFA.

The vast majority of LNG imports from Russia continue to flow to France, Spain and Belgium

Across the Union, Russian LNG imports have increased by 11 percent during the first half 2024. Strikingly Russia has surpassed Qatar to become the bloc’s second-largest supplier, trailing only the U.S.

In total IEEFA estimates that EU countries spent €3.5 billion to purchase LNG from Russia during the first six months of 2024.

The vast majority of LNG imports from Russia continue to flow to France, Spain and Belgium, which together account for 87 percent. French company TotalEnergies continues to be linked to the Yamal LNG project via a 20 percent minority ownership.

EU consumption likely to have peaked

The new study also concludes that EU LNG consumption has likely peaked and that across the continent an increasing share of LNG import terminals sit idle, highlighting that the EU’s construction spree following the full-scale invasion of Ukraine in February 2022 may have overshot its target.

The average utilization rate of EU LNG import terminals decreased from 62.8 percent during the first half of 2023 to 47.2 percent in 2024.