Russia's Novatek on Track to Complete 2nd Train of Arctic LNG 2 in 2024

Novatek’s Belokamenka construction yard near Murmansk. (Source: Novatek)

The final module for the 2nd production line of Russian gas producer Novatek’s Arctic LNG 2 project, departed from China last week. In February the company will integrate the last three modules ahead of towing the LNG train to the Gydan peninsula this summer. While US sanctions have not yet halted construction, it remains to be seen how much LNG Novatek will be able to sell.

In a major step toward completion of the second train - or liquefaction unit - of Russian gas producer Novatek’s Arctic LNG 2 project, the final prefabricated module left a Chinese construction yard bound for Murmansk in the Russian Arctic last week.

A LNG train consists of various components to process, purify, and convert natural gas to liquefied natural gas (LNG).

The module departed from the Penglai Jutal Offshore Engineering (PJOE) yard in Penglai in the Chinese province of Shandong aboard heavy load carrier Hunter Star on 15 January, shipping data and satellite imagery show. Industry sources confirmed to HNN that this shipment concludes module deliveries from China for Train 2.

Earlier in January two modules shipped from the same yard aboard Red Box’s carriers Audax and Pugnax.

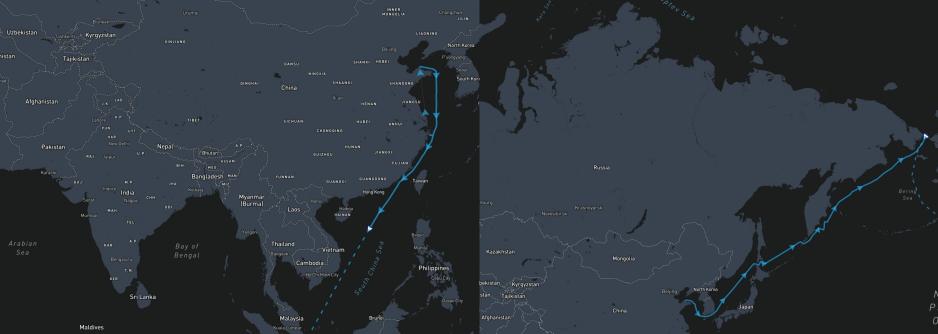

Route of Hunter Star (left) and Audax and Pugnax (right) following their departure from the Penglai Jutal Offshore Engineering (PJOE) yard in the Chinese province of Shandong. (Source: Maritime Optima)

Despite a months-long work stoppage by Chinese builders following Western sanctions in 2022, Novatek ultimately managed to secure all modules, including replacing Western turbines with Chinese imports. The modules will now undergo final assembly at the Belokamenka yard outside Murmansk.

The second train could be ready for sail-away this summer. Novatek aims to tow the gravity based structure (GBS) to the Utrenney terminal in Russia in August, explains Ben Seligman, a project specialist for Arctic oil and gas development.

“The main question in my mind would be the status of the LNG membrane storage system within the GBS, given GTT's departure from Russia a year ago,” Seligman cautions.

Gaztransport & Technigaz, or GTT, is a French multinational naval engineering company specializing in membrane containment systems for the transport and storage of liquefied gas.

Significant uncertainty looms

While the delivery of all twelve modules represents a significant step toward completing Train 2, the project’s overall future has become increasingly uncertain following targeted US sanctions. Novatek’s European, Japanese, and Chinese partners have exited the project under force majeure declarations.

It is possible that prices for sanctioned Russian LNG would be cheaper

The latest round sanctions bar the purchase and transport of LNG from the project. Thus, questions mount who Novatek will sell its LNG to and aboard which vessels it will deliver it. France’s TotalEnergies announced last week that it will not take receipt of any LNG from the project in 2024.

Novatek may try to sell its LNG at a discount on the spot market to buyers in Asia.

“It is possible that prices for sanctioned Russian LNG would be cheaper than for other supplies, but in this case, Chinese importers would have to resell their cargoes from other suppliers and replace them with Russian supply,” explains Jason Feer, global head of business intelligence at Poten & Partners.

“India would be in a similar situation, though they are more price sensitive so discounts on Russian supply may be more attractive."

The project’s future may in part hinge on the ability of Novatek's partners, including China’s state-owned oil major, the China National Offshore Oil Corporation (CNOOC) and China National Petroleum Corp (CNPC), to secure sanction exemptions.

Also read (the text contiues)

“But China and India may only be able to take Russian cargoes if they can get waivers of sanctions or if ship owners are willing to breach sanctions, which I doubt most are willing to do,” concludes Feer.

Production of LNG at the facility began about 3 weeks ago and storage tanks will reach capacity by the end of January according to industry reporting.

“It remains to be seen how Seapeak, Mitsui O.S.K. Lines (MOL) and Dynagas [operators of the Arc7 LNG carrier fleet. Journ.note] will react once the first cargo is ready to be loaded,” confirms Mehdy Touil, a LNG Operations Specialist, who in the past worked as a senior operator for Novatek’s Yamal project.

The ongoing expansion of the Russia-Ukraine War to include targeting Russian oil and gas infrastructure, including Novatek’s massive Ust-Luga fuel export complex over the weekend, could also complicate the future of the company’s Yamal LNG and Arctic LNG 2 projects.

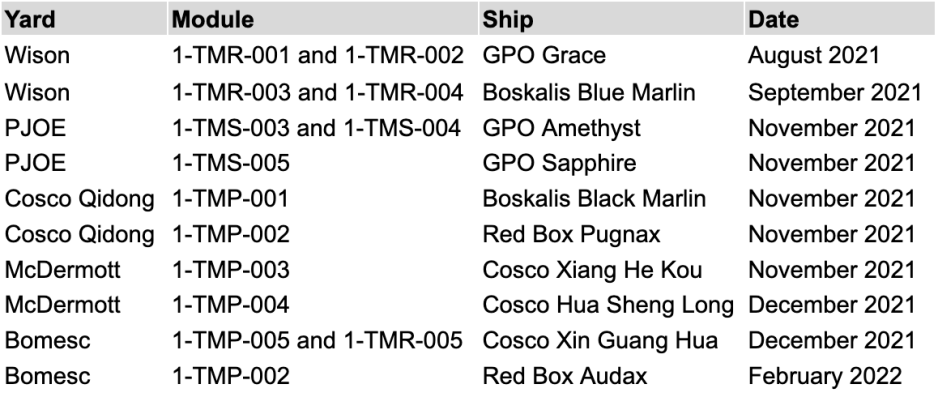

A dozen shipments across 15 months

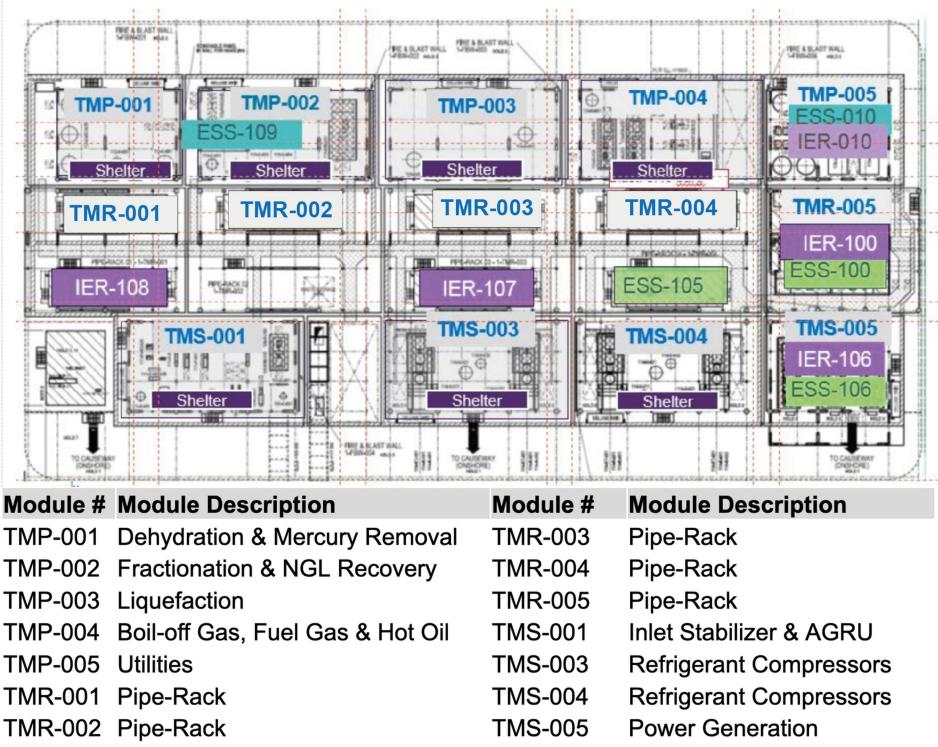

The departure of Hunter Star concludes a 15 months effort to transport a dozen modules to Murmansk in the face of a growing sanction regime. The first modules for Train 2 departed from Bomesc Offshore Engineering in China in October 2022, followed by additional shipments throughout the summer and fall of 2023.

In contrast, the delivery of fourteen modules for Train 1 – all constructed and delivered prior to sanctions in 2022 – took only seven months, from August 2021 until February 2022.

Image showing the twelve heavy load carriers that carried modules for Arctic LNG 2. (Photos by Kees Torn, Berg Knot, and Piet Sinke on Flickr.com under CC BY-SA 2.0 and courtesy of Red Box)

Without ice classification Hunter Star is required to take the long way around to Murmansk, either through the Suez Canal or rounding the Cape of Good Hope, rather than traveling the wintry Northern Sea Route (NSR).

In contrast, their polar ice classes permit Audax and Pugnax to travel through the Arctic, with both ships expected to enter the Northern Sea Route this week.

All three vessels are scheduled to arrive at Belokamenka in February with teams preparing skidding and integration operations for the modules on the gravity based structure, sources at the yard tell HNN.

In total a dozen heavy load carriers participated in the transport of the modules for Train 1 and Train 2, HNN data shows.

Shipments of Modules for Train 1 of Arctic LNG 2 by yard, module number, vessel and date. (Source: Author’s own work)

While several Western shipping companies, including Norwegian GPO and Dutch Boskalis, ceased transporting cargo following sanctions, other operators, such as Chinese COSCO and Dutch-Singaporean Red Box, continue lifting modules.

Shipments of Modules for Train 2 of Arctic LNG 2 by yard, module number, vessel and date. (Source: Author’s own work)

And Novatek will likely continue to rely on their services. This year may see the transport of initial modules for the final production line of Arctic LNG 2. The first four modules for Train 3 are nearing completion, satellite imagery shows.

Originally Novatek had planned to construct all fourteen modules for the final train on site at the Novatek Murmansk Plant, but project documents show that at least four modules will now originate in China.

Modules TMR-001 through TMR-004 for Train 3 of Arctic LNG 2 at the Wison yard on 16 January 2024. (Source: Planet.com)

Modules from five yards across China

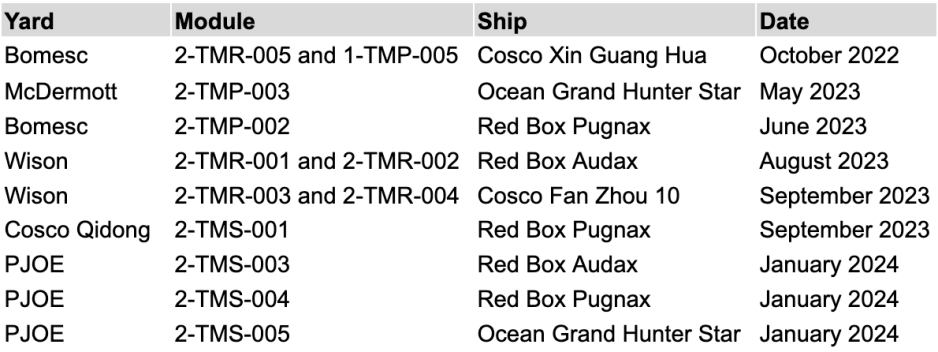

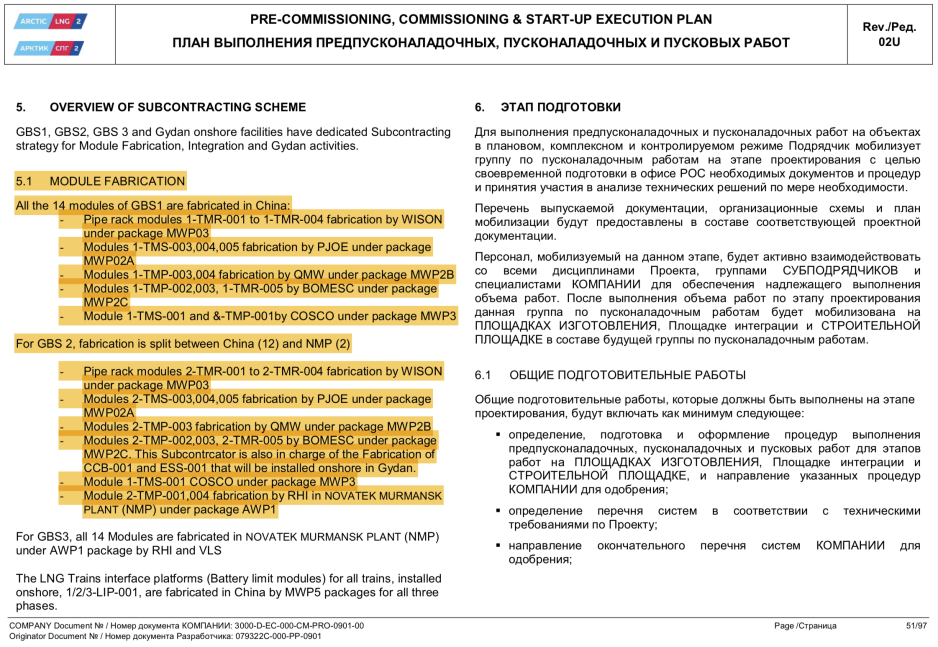

The construction of Arctic LNG 2 modules – each the size of half a soccer pitch and weighing up to 14,000 tons – is carried out across five yards in China. Each train, or production line, consists of fourteen modules, a Novatek diagram shows.

Diagram showing the arrangement of the fourteen modules on the GBS. (Source: Novatek pre-commissioning, commissioning & start-up execution plan)

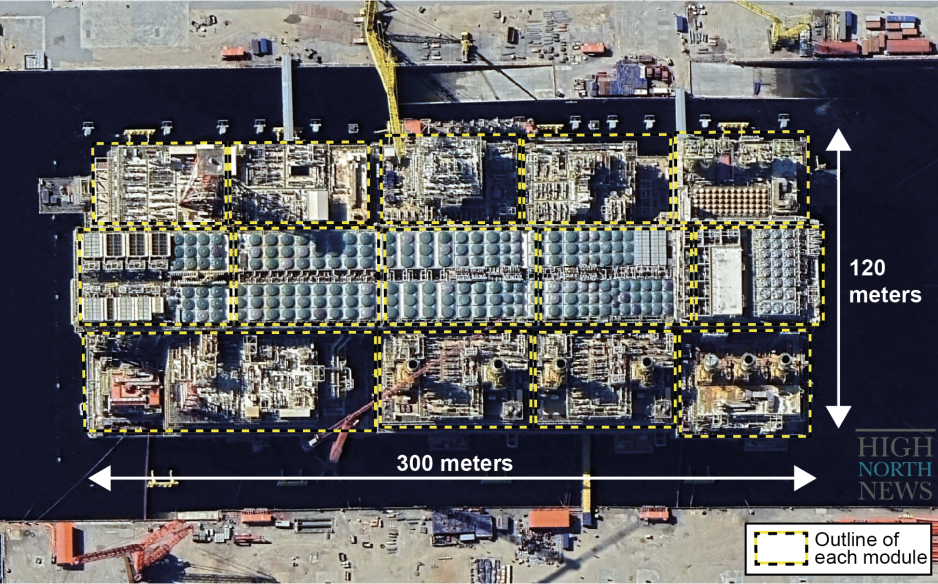

After arriving at Belokamenka modules are skidded onto a gravity-based structure and integrated to form the production line. Satellite images of the construction yard illustrate the final assembly of the fourteen modules into Train 1.

Annotated satellite image of Train 1 of Arctic LNG 2 showing each of the fourteen modules June 2023. (Source: Airbus)

For Train 1 all fourteen modules were constructed across China, for Train 2 two modules are produced locally at Belokamenka, with a dozen modules originating in China.

Novatek documents outline the distribution of modules across five Chinese yards.

Bomesc Offshore Engineering was awarded the largest construction contracts for module design and construction with a total contract value of over 6 billion Yuan (US$840m), across three contracts originating in July and November 2019 and June 2021. In total Bomesc was contracted to construct six modules, three for Train 1 and three for Train 2.

The contract comprises modules TMP-002, TMP-005, and TMR-005.

Penglai Jutal Offshore Engineering was also contracted for a total of six modules for Trains 1 and 2; though the modules are slightly smaller than those by Bomesc. The three PJOE modules are compressor modules TMS-003 and TMS-004 and power generation module TMS-005.

Details on module fabrication in China. (Source: Novatek pre-commissioning, commissioning & start-up execution plan)

Wison Offshore Engineering Module Development was contracted to manufacture eight modules, four for each train. The four pipe rack modules (TMR-001 to TMR-004) represent the core of each train and were thus the first modules to be shipped for Train 1 in August and September 2021.

Qingdao McDermott Wuchuan Module Development was contracted to construct three liquefaction modules for the project, with two modules bound for Train 1 and the third bound for Train 2. It constructed modules TMP-003 and TMP-004 for Train 1 and TMP-003 for Train 2.

Cosco (Qidong) Offshore Company constructed a total of three modules for Train 1 and Train 2. These include modules TMS-001 and TMP-001.

Modules TMS-003 to TMS-005 for Train 1 at the PJOE yard. (Source PJOE)

Redesigning the final module

Following Western sanctions Novatek was forced to redesign module 1-TMS-005, which houses the power supply.

A key challenge was the lack of LM9000 gas turbines by supplier Baker Hughes. The American company delivered four out of seven turbines before sanctions kicked in.

As a result Novatek was forced to modify the configuration of Train 1 and completely redesign Train 2.

Satellite images throughout 2023 and from the loading of Hunter Star indicate that work on the original TMS-005 module for Train 2 was abandoned and instead a new module, likely a modified version of TMS-005 to accommodate the Chinese electric motors, was constructed between May 2023 and January 2024.

The original TMS-005 for Train 2 currently remains at the PJOE yard, while Hunter Star loaded the apparent replacement module.

PengLai Jutal Offshore Engineering Heavy Industries Co. Ltd. (PJOE) yard in China on 14 January 2024 showing loading of the new TMS-005 module under way. (Source: Planet.com)

“There have been various modifications on TMS-003/4/5 to accommodate the electric motors and remove all the piping accessories related to the canceled LM9000s,” confirms an industry source familiar with developments at the Belokamenka yard.

The startup of Train 1 and the likely completion of Train 2 in 2024 indicate that thus far Novatek has been able to overcome the logistical and engineering challenges created by expanding US sanctions.

However, the question remains at which point the costs associated with repeatedly re-designing and re-engineering different aspects of the project become too great for Novatek to continue pushing ahead.