New Report: Busy Summer for Arctic Shipping on Russia’s Northern Sea Route

China's NewNew Polar Bear in a convoy on the Northern Sea Route during eastbound voyage in October 2023. (Source: Rosatomflot)

Traffic between Russia and China continues to be the driver for Arctic transit shipping traffic on the Northern Sea Route, a new report by Center for High North Logistics shows. Crude oil, coal, and iron ore are flowing from Russia to China, while container shipping is occurring almost equally in both directions.

The first two months of the 2024 summer and fall navigation season on Russia’s main Arctic shipping lane have already seen 30 transit voyages carrying around 1.3 million tons of cargo, a new report by Norway’s Center for High North Logistics (CHNL) details.

The analysis of shipping traffic highlights that the Russia-China connection for Arctic development and shipping continues to dominate, with 98 percent of cargo flowing between ports of the two countries.

The cargo flow from Russia to China is dominated by crude oil and bulk items like coal and iron ore.

900,000 tons of crude oil

Thus far nine oil tankers have traveled from the Baltic port of Primorsk, Murmansk and the Prirazlomnaya oil platform to China with around 900,000 tons of crude oil.

Five bulk carriers delivered approximately 416,000 tons, a mix of coal, iron ore and mineral fertilizers. Vessels again originated in the Baltic Sea and Murmansk.

The opposite direction has seen less traffic with bulk vessels and tankers vessels frequently returning in ballast.

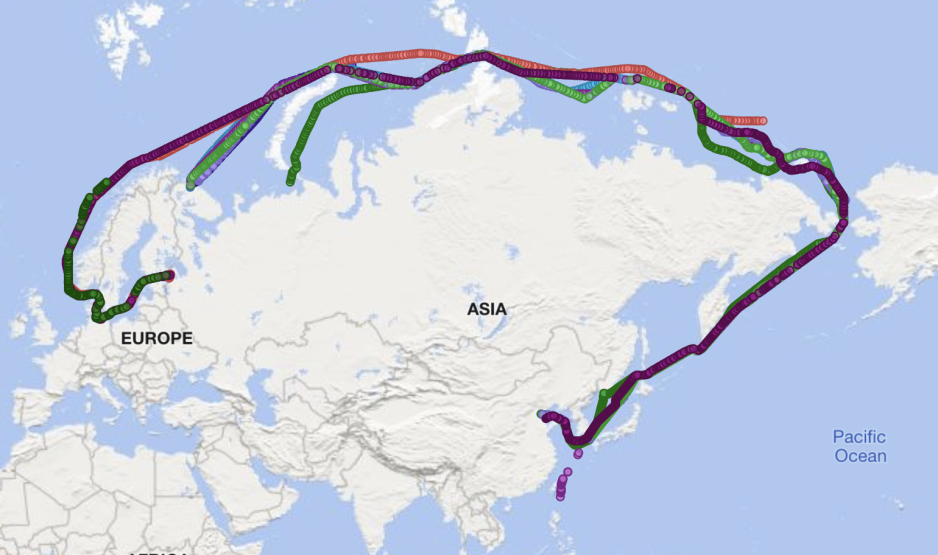

Crude oil traffic transiting through the Northern Sea Route during the first half of the summer navigation season through August 28, 2024. (Source: CHNL)

But container shipping represents an exception to this with vessels carrying cargo in similar measures in both directions.

Four Chinese or Hong Kong-based box ships carried around 17,000 tons of containerized cargo from China to the Russian port of Arkhangelsk, with two making the return voyage loaded with 11,000 tons.

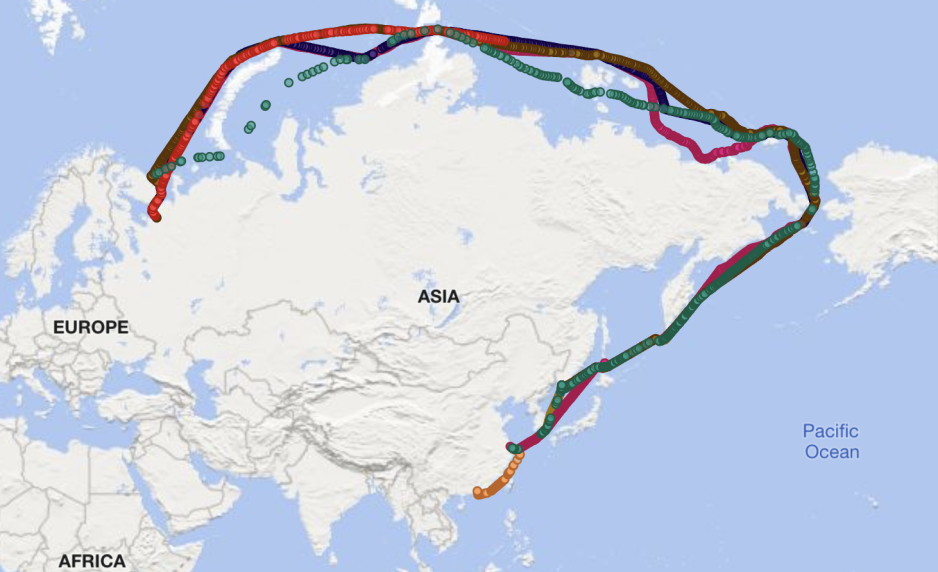

Container traffic transiting through the Northern Sea Route during the first half of the summer navigation season through August 28, 2024. (Source: CHNL)

Those figures look set to grow substantially during the coming two months as several larger container ships have entered the route in recent days, including the first-ever Panamax, Flying Fish 1, passing through the Arctic.

Concentrated on Russia and China

While transit shipping experiences significant seasonal variability, it by and large remains highly concentrated on Russian ports. The experts at CHNL note that during the first two months of this summer’s shipping season, no international transits have been recorded.

All vessels either originated or arrived in a Russian port. During previous summers, especially prior to the full-scale invasion of Ukraine, the route saw some international traffic connecting port pairs outside of Russia.

At the current rate, and taking into account that September is the busiest month, the CHNL suggests that 2024 transit traffic will surpass last year’s record of 2.1 million tons.

Near Murmansk

Transit traffic routinely continues into November and possibly longer depending on vessel ice-classification and ice conditions. However, in some years conditions can rapidly deteriorate trapping vessels in quickly forming sea ice requiring rescue by Russia’s icebreaking fleet.

Additional volume may come from Russia’s emerging LNG shadow fleet. Several cargo loads of LNG from the sanctioned Arctic LNG 2 project have initially been transported in a westerly direction to a holding point near Murmansk.

They may eventually be transshipped and flow in an easterly direction to Asia adding to the transit traffic contingent. Some changes to the Northern Sea Route traffic pattern may also emerge next summer as an EU-wide transshipment ban on Russian LNG comes into effect in March 2025.