EU Looking to Pass 14th Sanctions Package End of June, Including Partial Ban on Russian LNG

Flags in front of the European Commission building in Brussels. (Source: TeaMeister under CC BY-NC 2.0 DEED)

The pathway for the 14th EU sanctions package and related measures against Russia’s liquefied natural gas sector continues to materialize. European Commissioner for Energy Kadri Simson expressed optimism that the measures could be agreed upon by the end of June.

The next EU sanctions package against Russia, slated to include measures against the country’s Russia’s liquefied natural gas (LNG) sector, could come as early as late June, European Commissioner for Energy Kadri Simson confirmed last week.

“I am optimistic that the 14th package will be unanimously approved. But this can all happen only at a summit,” she explained.

The next European Council meeting is scheduled to take place in Brussels on June 27-28.

During an interview with Estonian state media ERR, Simson confirmed that the package will contain measures aimed at “limiting the Russian Federation’s income from the sale of LNG by banning the use of EU infrastructure for transshipment of Russian LNG to third countries.”

The measure comes at a time when Russia is looking to rapidly expand its LNG production capacity. Currently around 25-30 percent of LNG from the country’s largest project, Yamal LNG, passes through EU terminals.

We never propose sanctions that would harm the European economy more than they negatively impact the Russian economy

“Russia is looking for new markets for its natural gas and would like to increase its LNG production capacity. But we are limiting its access to technology and financing: Ust-Luga 2, Murmansk, Arctic LNG 2 are projects that do not have a direct impact on the market now, but will affect Russian production volumes after 2025 ", Simson elaborated.

The proposed ban appears to be designed to curb Russia’s ability to export LNG to third countries without immediately affecting the EU’s energy stability.

“We never propose sanctions that would harm the European economy more than they negatively impact the Russian economy. So, this proposal has also been thoroughly prepared," Simson confirmed.

EU terminals are critical to Russia

Without the ability to use EU terminals for reloading of LNG, Russia will have to fundamentally redesign its logistic networks. Direct exports from the Russian Arctic to markets in Asia require ice-capable vessels, some of which have been blocked by sanctions at shipyards in South Korea. And Russian shipyards have been struggling to build the vessels domestically.

Alternatively, producers like Novatek could resort to ship-to-ship transfers outside the Arctic’s icy waters. But lengthy voyages from Russia’s high latitudes to markets in Asia via the Mediterranean and Suez Canal would complicate the economic viability of Arctic projects.

To eliminate the need for ice-capable LNG carriers Novatek aims to construct its next project in the ice-free waters near Murmansk.

Targets vessels contributing to war effort

The draft package, approved by the European Commission earlier this month is currently being discussed among the permanent representatives of the EU member states.

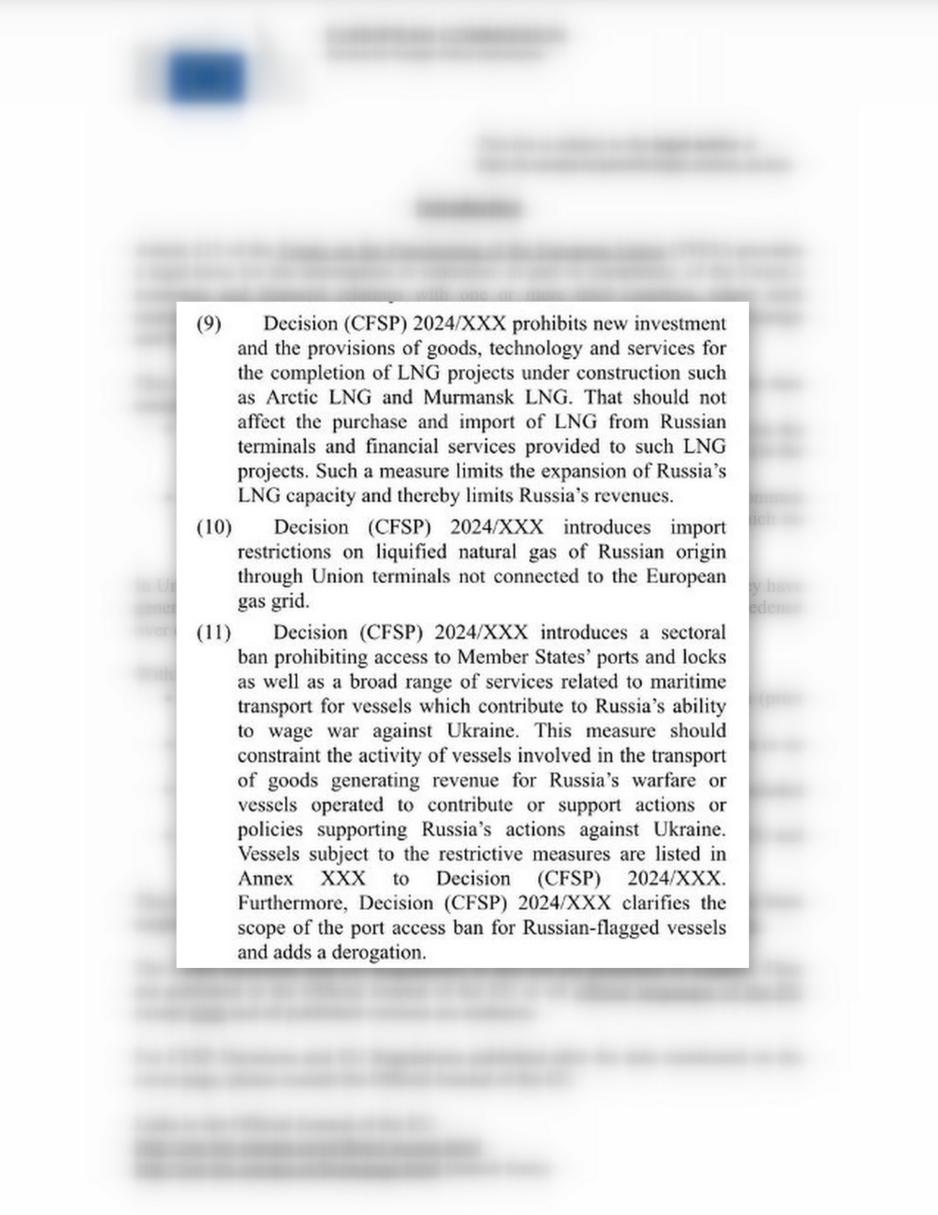

The draft text, a copy of which has been seen by HNN, broadly targets Russia’s LNG sector by prohibiting “new investment and the provisions of goods, technology and services for the completion of LNG projects under construction such as Arctic LNG and Murmansk LNG.”

But it does not directly target the import of LNG from these projects.

Instead the measure aims “to limit the expansion of Russia’s LNG capacity and thereby limits Russia’s revenues.”

A greater potential impact could arise from the 11th paragraph of the proposed draft, calling for “a sectoral ban prohibiting access to Member States’ ports […] for vessels which contribute to Russia’s ability to wage war against Russia.”

The draft text further states that “this measure should constrain the activity of vessels involved in the transport of goods generating revenue for Russia’s warfare or vessels operated to contribute or support actions of policies supporting Russia’s actions against Ukraine.”

This broad definition could include Arc7 LNG vessels carrying Russian gas into the EU, though a list of vessels has not been released.

Yamal LNG’s exact level of contribution to Russia’s federal budget has been much debated. The project remains exempt from export duty and Mineral Extraction Tax, limiting its overall federal taxation rate.