EU Efforts to Reduce Russian LNG Ring Hollow as Imports Reach New High

EU and Ukraine flags in Brussels 2024. (Source: Courtesy of and © European Union, 2024 - EP)

The EU and its member states remain unable to control the inflow of Russian liquefied natural gas. Despite voluntary measures and repeated discussions in Brussels, imports have now reached new record highs. The upcoming transshipment ban in March 2025 could inadvertently further increase imports.

EU member states are unable to break their continued reliance on Russian liquefied natural gas (LNG).

Over the past two years a number of EU and member state officials have repeatedly urged action to curtail the unfettered inflow of the pricey chilled Russian gas, but so far to no avail.

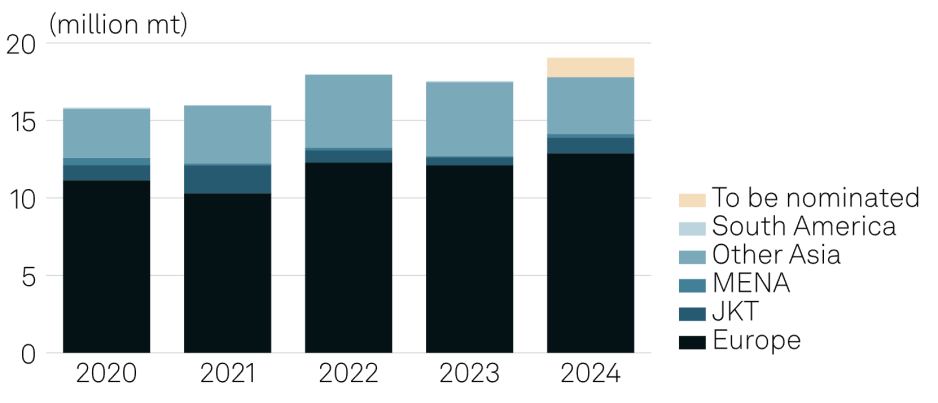

The latest figures confirm that not only have imports not decreased year-over-year but have in fact increased substantially over the same period in 2023. Between January 1 and October 23, 2024 the continent received 314 shipments of Russian LNG totaling 19.05 million tonnes.

An increase of nearly 10 percent over the entirety of 2023 when 17.53 million tonnes found their way into Europe. With two months remaining before the end of the year, imports will undoubtedly increase further.

Europe remains key Russian market

While much has been written about Russia’s re-orientation to Asia for its LNG exports, it continues to rely heavily on the European market. This year 68 percent of all Russian LNG exports were destined for the West, with 27 percent bound for Asia.

In fact Russian LNG exports to Europe have never been higher, the S&P Global figures reveal. At the same time deliveries to Asia have reached the lowest figure since 2020.

As a result of the rising absolute figures, the share of Russian LNG as a total of Europe’s total imports of chilled gas, has also increased significantly.

While that figure stood at 12 percent in 2022 and 2023, it has now increased to 17 percent through the measurement period at the end of October.

Russian LNG exports by destination. Data for each year between January 1 through October 23. (Source: S&P Global Commodity Insights)

Just last week EU member state officials, led by Belgium’s energy minister Tinne Van der Straeten, proposed an EU-wide monitoring system to track Russian LNG once it enters the continental network.

This suggested measures comes ahead of the transshipment ban taking effect in March 2025. While that agreed upon policy as part of the 14th sanctions package will prohibit the re-export of Russian LNG, it may have the inadvertent effect of further increasing EU imports.

Those volumes that previously passed through EU terminals before being transshipped to 3rd countries like India and China, may now simply be absorbed into the European market.

Concerns about price increases

France’s TotalEnergies, a partner in Russia’s Yamal LNG project, where the vast majority of EU imports originate, suggested that the hesitation to phase-out of Russian LNG relates to concerns about higher costs.

“There will be higher cost[s],” the company’s head of strategy for gas, power and renewables Cecile Ballantyne Jovene, suggested over the weekend.

Others however, including industry analysts Wood Mackenzie and Belgian think tank Bruegel, express confidence that with significant global supply expansion in 2025 and ongoing European demand destruction, the phaseout of Russian LNG could occur without much impact on energy security and prices for consumers.

Meanwhile Norway continues to supply record-levels of gas to Europe to make up for the shortfall in Russian pipeline gas. Norway’s largest gas field, Equinor’s Troll field, set a new record for gas supply to Europe over the past 12 months.

Troll alone can cover 11 percent of European gas demand and production levels are expected to remain stable through 2023 following a NOK 12 billion (USD1.1 billion) investment in the field.