China Looking to Buy More Russian Arctic LNG as EU Aims to Announce Plans in May to Phase Out Imports

Yamal LNG with Arc7 LNG carrier in the foreground. (Source: Novatek)

As the EU is gearing up to publish its roadmap to phase out Russian LNG, China’s appetite for deliveries of supercooled gas from the Arctic could see a rise in the coming months. Whether China will also welcome cargoes from the sanctioned Arctic LNG 2 project remains a key question.

China may be looking in to buy more Russian LNG in 2025 as the EU readies plans to phase out energy imports from the country by 2027.

In comments made earlier this week China’s ambassador to Russia, Zhang Hanhui, indicated that importers in his country are looking to buy greater quantities of liquefied natural gas (LNG). Currently China receives the fuel from two Russian plants, Yamal LNG in the Arctic and Sakhalin-2 in the Far East. There is limited spare capacity at either facility.

A third plant, Arctic LNG 2, remains partially completed and in limbo as U.S. sanctions have slowed down construction and shuttered initial deliveries during summer 2024. Originally intended to export primarily to the Asian market, buyers in China were reluctant to touch sanctioned cargoes for fear of secondary sanctions by the U.S. Officials under the former Biden Administration targeted the expansion of Russian LNG production with rapid-fire sanctions, including technology suppliers in China.

With no new sanctions against Russian Arctic energy projects since January 10th, those fears on the part of Chinese buyers may now be subsiding sources familiar with the industry report. China may be welcoming deliveries from Arctic LNG 2 in the months to come as winter sea ice retreats. Direct shipments from Arctic LNG 2 to China remain unlikely, but deliveries via ship-to-ship transfers may now have the backing of Beijing. Cargoes could also be reloaded at a floating storage barge, Koryak, located in Kamchatka, though the facility itself is also sanctioned.

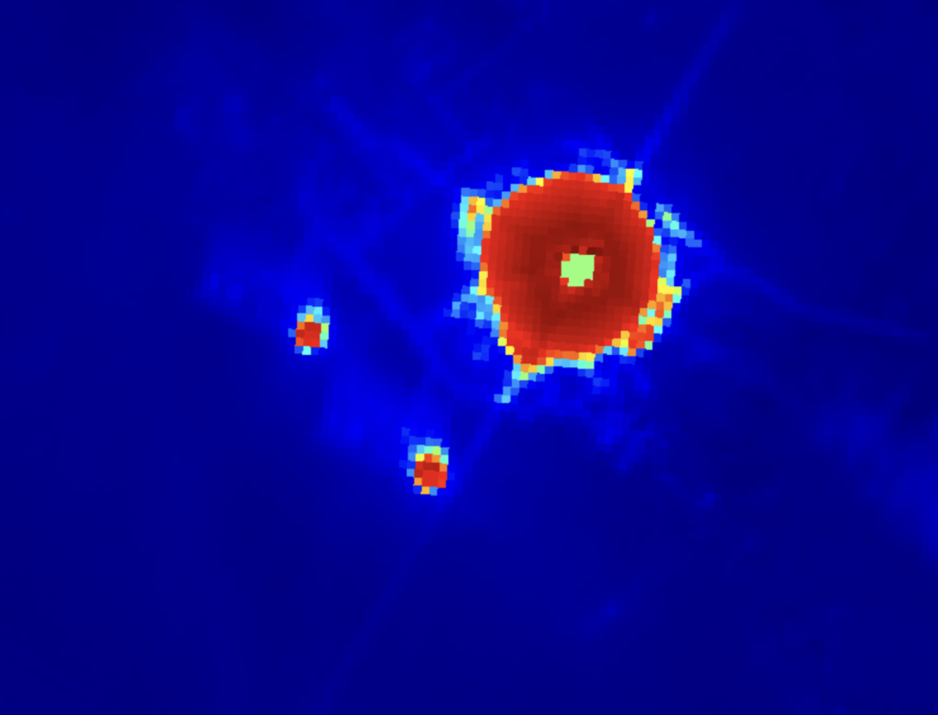

Recent activity at Arctic LNG 2 itself also possibly indicates a readying for summer production. Satellite images show gas flaring starting at both production lines, Train 1 and Train 2, at the end of March. The activity may be related to the commissioning of Train 2 and equipment maintenance inside Train 1, but if the flaring continues for an extended period it could also signal the re-start of production.

April 14, 2025 satellite image showing gas flaring continuing at Arctic LNG 2 from both Train 1 and Train 2 as well as the main flare. (Source: Sentinel 2)

Sea ice around the Utrenney terminal will start to break up next month and Ob Bay, where the plant is located, is usually ice-free and reachable by low ice-class or even conventional LNG carriers by early July.

As China is looking to increase its supply of Russian LNG, the EU is readying a proposal to phase out the fuel by 2027. The bloc has been discussing the matter of ending Russian LNG imports for much of the past three years with various sanctions initiatives, including by a group of 10 states, ultimately faltering in Brussels.

The release of the roadmap to end Russian gas imports has been delayed several times by the European Commission. The decision will require unanimity by all member states. Several EU states, including Hungary and Slovakia, still rely on pipeline gas from the country, while others, led by France and Belgium, continue to welcome shipments of Arctic LNG.

Pledges by EU officials and member states to purchase greater quantities of US-made LNG in an effort to appease the Trump administration in the escalating trade war, could also narrow the path for future Russian imports into the continent. At the same time, the recent tariffs between the U.S. and China, could make Russian LNG more competitive on the Chinese market.