Arctic Shipping on the Northern Sea Route in Deep Freeze?

NS 50 "Let Pobedy" near Franz Josef Land during Summer 2015 (Source: Christopher Michel)

Economic factors, such as reduced bunker fuel prices and slowing demand for commodities, are the primary reasons for reduced shipping traffic along Russia’s Northern Sea Route, according to research presented by Arctic shipping experts at Bodø’s High North Dialogue conference. Higher amounts of summer sea ice during 2014 and 2015, on the other hand, only play a minor role. What does this mean for the future prospects of Arctic shipping?

Interest in the commercial use of Arctic shipping routes first emerged following the rapid decline in summer sea ice in 2007.

If the Arctic Ocean would become ice free during the summer months in the near future, the thinking went, it could serve as a shortcut for vessels travelling between Europe and Asia.

The Northern Sea Route (NSR), as well as its less popular Canadian cousin the Northwest Passage (NWP), can cut the distance on popular routes, such as Rotterdam (Netherlands) to Shanghai (China), by up to 35 percent potentially offering significant time and fuel cost savings.

Shipping traffic on the NSR steadily increased since the first non-Russian flagged voyages in 2009 and reached 71 transits carrying 1.35 million tons of cargo in 2013.

However, since then shipping volumes on the route have declined sharply falling to a low of just 18 transits and 40,000 tons in 2015. Have the prospects of Arctic shipping been oversold and what explains the lack of interest in utilizing the NSR since 2013?

The economic calculations have changed

Arctic Shipping Sensitive to Global Economy

Felix Tschudi, Chair and owner of the Tschudi Group, a shipping and investment company based in Oslo, identifies the fallen bunker fuel prices as a key reason for the decline in Arctic shipping.

As fuels expenditures have decreased sharply, the cost of transportation has become less significant for shipping operators and with that shortcuts have become less economically attractive.

"The economic calculations have changed since 2013 and the benefits of the NSR as a shortcut have largely been lost," explains Tschudi to HNN. "The value of the time saved is much less compared to 2013."

In addition, commodity prices of raw materials have fallen sharply in part due to declining demand, especially in Asia. As a result the value-to-weight ratio of transported goods has decreased placing larger emphasis on economies of scale.

Also read (the text continues)

Simply put, when prices are low it becomes more important to ship commodities on larger vessels as it reduces the relative cost of transportation.

Ice-hardened vessels capable of operating on the NSR are much smaller and regular vessels requiring icebreaker escorts have to abide by size and draft restrictions.

"At the current price levels commodities are no longer able to carry the transportation costs on the NSR," Tschudi points out to HNN.

Reduced Availability of Icebreakers

An additional factor, according to Tschudi, is the reduced availability of icebreaker escorts from Rosatomflot, the world’s only company maintaining a fleet of nuclear-powered icebreakers.

While Atomflot was keen to provide icebreaker escort services in previous years, the ongoing and growing construction of the Yamal LNG gas project and the Port of Sabetta have tied up capacity reducing the company's ability to escort and assist commercial shipping operations.

Ice Extent Variability Minor Factor

Contrary to popular belief, summer sea ice extent across the Arctic Ocean only plays a minor role in determining the popularity of the region’s shipping routes.

Laurence Smith, Professor and Chair of the Geography Department at the University of California Los Angeles, emphasized that ice extent variations over the past few years as well as projected variability in the future are but one of many factors.

“Ice extent variability under different climate forcings factors in little into the overall economic equation of Arctic shipping,” stated Smith during his talk at the University where he presented research on the impact of climate model variability on future Arctic shipping.

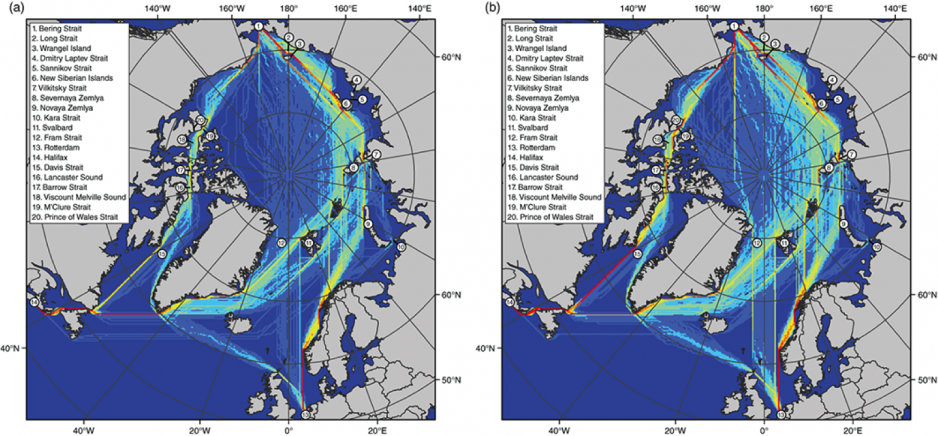

Their model shows a simulated future of sea ice extent based on climate models and then calculates the fastest routes through the Arctic Ocean. Based on their research the NSR is highly likely to remain the preferred Arctic shipping route, with only some outlier models predicting the NWP as a significant transport route.

In the second part of the 21st century, a more direct transpolar sea route outside the Russian Exclusive Economic Zone closer to the North Pole may also become feasible.

Arctic Shipping Remains A Complex Equation

The economic complexities described by Tschudi and Smith surrounding the viability of Arctic shipping were also the subject of research published by the Copenhagen Business School earlier this year. The study identified more than a dozen variables, ranging from ship hull design and fuel prices to cargo types and routes served, as key determinants of cost on the NSR. It concluded that summer ice extent and length of navigability on the NSR are just one of many variables.

"The fall in oil prices has lowered the incentive of using the Arctic routes despite the reduced sailing distances. Low oil prices diminish the large distance benefits on the Northern Sea Route as fuel costs decline throughout the shipping industry," explains Peter Grønsedt, lead author of the study and researcher at CBS.

While forecasts of a rapid increase of traffic on the NSR may have been proven overly optimistic, the current slump is merely temporary, emphasized Tschudi. Transit traffic may be down but a lot of internal and destination traffic is still going on delivering infrastructure supplies into the Arctic and carrying hydrocarbon resources out of it. Thus, Tschudi concluded: "Arctic shipping is not dead, but it’s been put on ice temporarily."