EU Countries Continue to Import $1bn of Russian Arctic LNG Every Month

Fluxys LNG terminal in Zeebrugge, Belgium with a Russian Arctic LNG carrier unloading LNG. (Source: Courtesy of Fluxys)

Almost two years into the full-scale invasion of Ukraine, European countries continue to import Russian Arctic liquefied natural gas at record levels. A new report details how LNG now constitutes the primary Russian fossil fuel purchased by the EU, sending more than $1bn per month to the country.

A new Ukranian analysis on the proliferation of Russian fossil fuel highlights the continued and unabated import of liquefied natural gas (LNG) by EU countries. In contrast to the United States, the EU has thus far not placed any sanctions on the import of LNG.

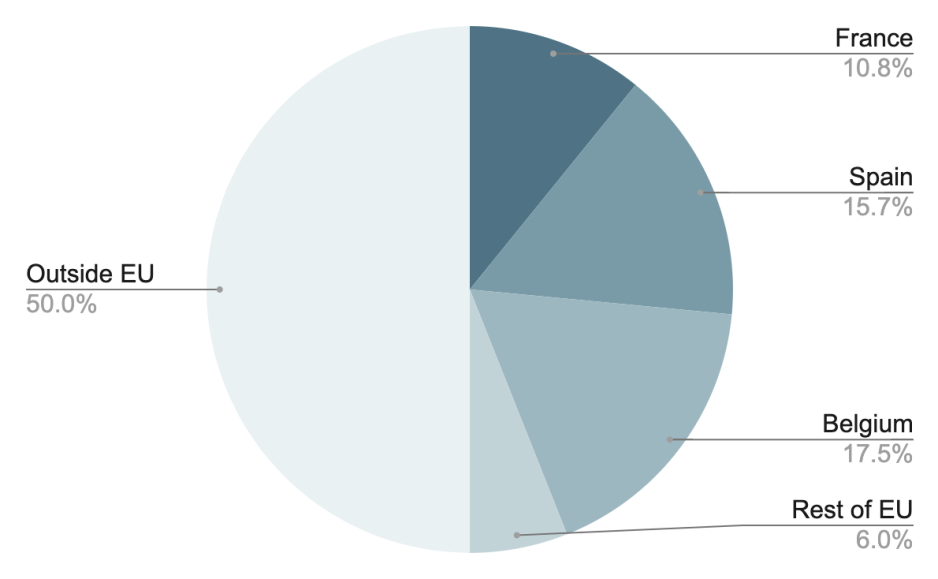

As a result the EU remains a destination for 50 percent of Russia’s LNG exports sending in excess of $1bn each month to the country.

“Russia saw a surge in revenue from LNG exports, particularly as its LNG remains unsanctioned by the EU. From December 2022 to October 2023, half of Russia's LNG exports, totalling EUR 8.3 billion, were directed to the EU market,” the report details.

It is the Ukrainian organization Razom We Stand that is behind the report, calling for a total and permanent embargo on Russian fossil fuels and an immediate end to all investment into Russian oil and gas companies.

While up to a dozen EU countries have received Russian LNG since February 2022, the key importers remain Belgium, Spain, and France, which together account for 88 percent of the EU’s Russian LNG imports during the last 10 months.

Share of Russian LNG exports by destination. (Source: Author’s own work)

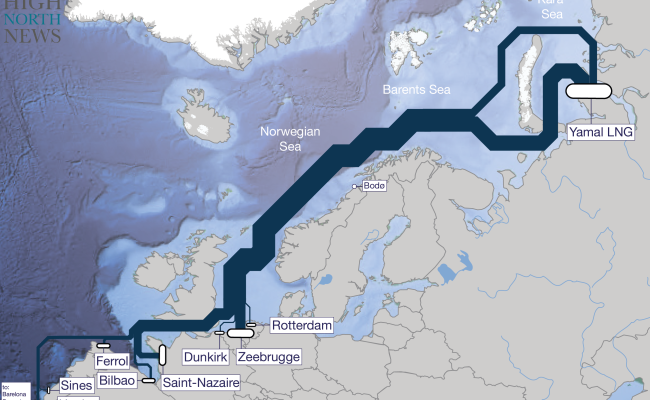

EU ports receive in excess of 200 shipments from Russia’s Yamal LNG facility per year. The volume of imported LNG is now so significant that it has surpassed other forms of Russian fossil fuels.

“LNG constituted the primary fossil fuel type purchased by the EU from Russia in January- November 2023,” the analysis emphasizes.

All of this LNG is produced by the Yamal plant located in the Russian Arctic. With a second project, Arctic LNG 2, slated to come online in the coming weeks, EU imports could increase further in 2024.

EU ports help Russian LNG

The EU also facilitates the transshipment of Russian LNG to buyers outside the continent. More than 20 percent of Yamal LNG passes through terminals in Europe where it is reloaded from specialized ice-capable carriers to conventional LNG tankers for onward transport.

A key hub is the port of Zeebrugge, where Fluxys, a natural gas transmission system operator, runs a regasification and storage terminal. The company signed a long-term storage agreement – through 2035 – with Novatek in 2015. The deal allows for up to 8m tons of LNG, around 105 shipments, to pass through the facility.

The transfer of LNG has become a crucial component of Russia’s Arctic LNG operation allowing it to maximize the use of its limited Arctic fleet. With South Korean shipyards DSME and SHI canceling contracts for additional ice-class LNG carriers due to sanctions, the transshipment of LNG in Europe has gained further importance.

“EU Member States should immediately ban transhipment of Russian LNG in their ports that further travels onwards to non-EU destinations. Russia is reliant on these ports for the logistics and storage of LNG that travel to non-EU destinations,” the report’s authors recommend.

Phasing out the transhipment of Russian LNG appears to be a low-hanging fruit as it would complicate Russia’s LNG exports without impacting EU energy security. The US recently announced sanctions aimed at curtailing Russia’s transshipment efforts, but according to EU officials the bloc does not currently have plans to follow suit.

European companies also remain involved in the operation of Novatek’s fleet of LNG carriers. Norway’s Assuranceforeningen Skuld, an Oslo-based marine insurance company, continues to provide protection and indemnity insurance to three of the LNG tankers which shuttle LNG between the Arctic and markets in Europe.